China’s US Treasury holdings have dropped to 2009 ranges after its central financial institution bought greater than $8 billion within the month of April.

In line with a brand new replace from the Treasury Division, China held $757.2 billion value of Treasuries on the finish of April 2025 – down from $765.4 billion in March and $784.3 in February.

China now holds considerably fewer T-bills than the UK’s $807.7 billion, and sits in third place on the checklist of the most important main overseas holders of Treasuries after over 17 years of being in second place.

China’s huge offloading of Treasuries seems to be a part of a broader reconfiguration of the nation’s monetary technique.

Macro analyst Adam Kobeissi reviews that China’s Treasury-dumping spree has coincided with a particularly aggressive accumulation of gold that has solely accelerated since 2022.

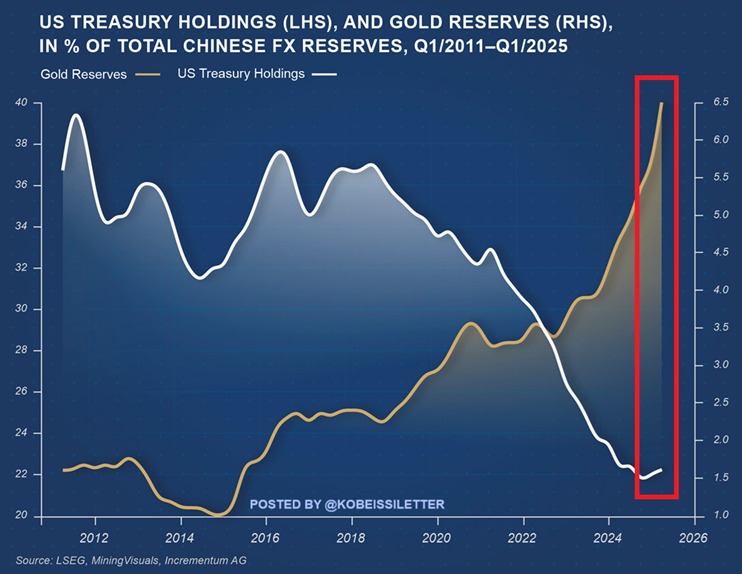

“China is diversifying its forex reserves out of the US Greenback:

The share of US Treasury Holdings in complete Chinese language FX reserves has declined by ~15 share factors since 2016, to ~22%, close to the bottom in not less than 15 years.

Over the identical interval, gold’s share has risen ~5 share factors, to a report 6.8%.

This development accelerated in 2022, and since then, gold’s share of Chinese language reserves has doubled.

Over this time, China has acquired ~200 tonnes of gold.

Gold is extra desired than ever.”

Since 2022, the US greenback index (DXY), which measures the energy of the USD towards a weighted basked of different main foreign currency, is down over 15% since 2022, creating skepticism in regards to the buck’s future as a world reserve asset.

Final week, “Black Swan” writer Nassim Taleb stated that the greenback had already been successfully been changed by gold because the world’s reserve forex.

Says Taleb,

“You may see the buildup of gold within the reserves and the habits of gold over the previous 12 months. And it didn’t begin with Trump’s insurance policies. In fact, it began with Biden when he froze the accounts of individuals related to Putin, and naturally, pondering that it could be restricted there, however folks not related to Putin determined to avoid the euro and the greenback.

And gold is successfully now the reserve forex. Transactions happen in {dollars} and euros, often {dollars}, and on the similar fee, nevertheless, they get transformed again into gold. And we will see that from the buildup of reserves.”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Value Motion

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney