- Invesco and Galaxy Digital filed for the Invesco Galaxy Solana ETF, aiming to record underneath the ticker QSOL on the Cboe BZX Alternate.

- Coinbase Custody will safe the fund’s SOL holdings, with Galaxy managing token acquisition and Invesco sponsoring the ETF.

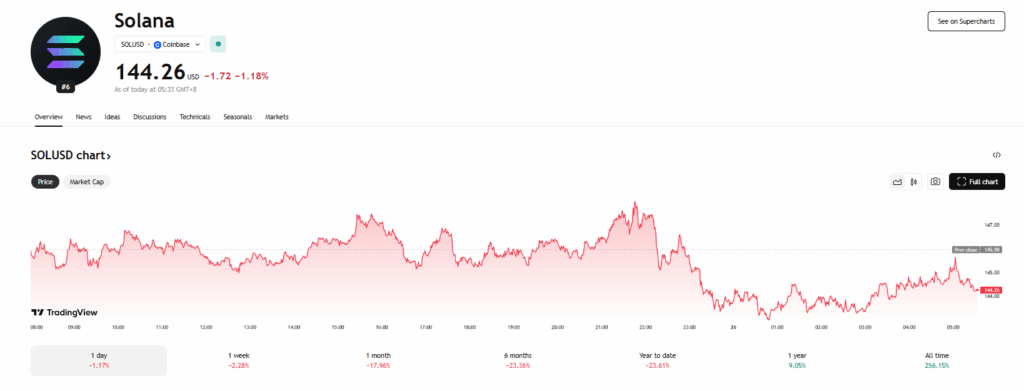

- The SEC’s latest request for up to date filings indicators potential ETF approvals quickly, as curiosity surges throughout Solana, DOGE, XRP, and even NFT-linked funds like PENGU.

The race to launch a spot Solana ETF is heating up. Invesco Ltd and Galaxy Digital LP have formally thrown their hats into the ring, submitting a registration assertion with the SEC for the Invesco Galaxy Solana ETF. If greenlit, this ETF would commerce on the Cboe BZX Alternate underneath the ticker QSOL—including one other main participant to the rising Solana ETF lineup.

Key Gamers and Fund Construction

Within the submitting, Invesco Capital Administration LLC is listed because the sponsor of the ETF, whereas Financial institution of New York Mellon will function administrator. Galaxy Digital will deal with acquisition of the particular SOL tokens, and Coinbase Custody Belief Firm is ready to safeguard the belongings.

This structured partnership amongst seasoned conventional finance and crypto-native companies indicators a maturing market strategy to Solana as a legit asset class. The submitting provides credibility to Solana’s narrative as greater than only a quick blockchain—it’s now gaining institutional traction.

The Broader Solana ETF Panorama

The Invesco-Galaxy software joins a crowded area, with VanEck, Bitwise, and 21Shares all pushing for SEC approval of their very own Solana-based merchandise. The curiosity stems from each rising investor demand and shifting regulatory tides.

Following the Biden-era approval of spot Bitcoin and Ethereum ETFs, optimism surged that various Layer 1 tokens like Solana, Dogecoin, and XRP might quickly see regulatory readability and public market publicity.

The truth is, the SEC not too long ago requested S-1 updates from a number of Solana ETF candidates—a transfer extensively interpreted as signaling that approvals could also be nearer than anticipated.

Parallel Momentum: Canary PENGU ETF Additionally Advances

In a associated growth, Cboe BZX filed a Kind 19b-4 on the identical day for Canary Capital’s PENGU ETF, which holds Solana-based meme token PENGU together with Pudgy Penguin NFTs. First filed in March, it’s one of the distinctive crypto ETF proposals up to now, combining meme cash, NFTs, and blockchain infrastructure belongings.

Collectively, these filings spotlight a regulatory shift that’s more and more embracing tokenized belongings—together with non-traditional performs like meme cash and NFTs—underneath institutional frameworks.