Trusted Editorial content material, reviewed by main trade consultants and seasoned editors. Advert Disclosure

As Bitcoin and different digital property recuperate, knowledge exhibits the sentiment amongst cryptocurrency traders has returned to a state of greed.

Bitcoin Concern & Greed Index Is Pointing At Greed Once more

The “Concern & Greed Index” refers to an indicator made by Different that measures the web sentiment held by the common dealer within the Bitcoin and wider cryptocurrency areas.

The index makes use of the information of the next 5 components to find out the market sentiment: buying and selling quantity, volatility, market cap dominance, social media sentiment, and Google Traits.

The metric represents the calculated mentality as a rating mendacity between 0 and 100. The previous finish level corresponds to a state of most concern, whereas the latter one to that of most greed.

Right here’s what the index says concerning the present sentiment among the many traders:

Seems like the worth of the metric is 65 in the mean time | Supply: Different

As displayed above, the Bitcoin Concern & Greed Index has a price of 65, which suggests the merchants at present share a majority sentiment of greed. This can be a notable change in comparison with yesterday, when the indicator was sitting at 47, which means that the investor mentality was general impartial.

The development within the Concern & Greed Index over the previous twelve months | Supply: Different

The holder sentiment earlier declined on account of the geopolitical scenario surrounding the Israel-Iran battle. Following the announcement of a ceasefire between the nations, costs bounced again and it will seem that with them, so did the investor temper.

The ceasefire has since been violated, so it’s doable that tomorrow’s Concern & Greed Index can be much less bullish. That stated, Bitcoin has held surprisingly nicely regardless of the information, which might indicate that the sentiment may stay the identical.

Traditionally, BTC and digital property typically have tended to maneuver within the path that goes towards the expectations of the traders. Because of this an excessively grasping market makes tops seemingly, whereas an especially fearful one bottoms.

At current, the extent of greed out there isn’t too robust, however the truth that it has seen a notable bounce alongside the restoration run might nonetheless be to take word off. Within the state of affairs that hype retains rising within the coming days, one other reversal might flip extra possible for Bitcoin and firm.

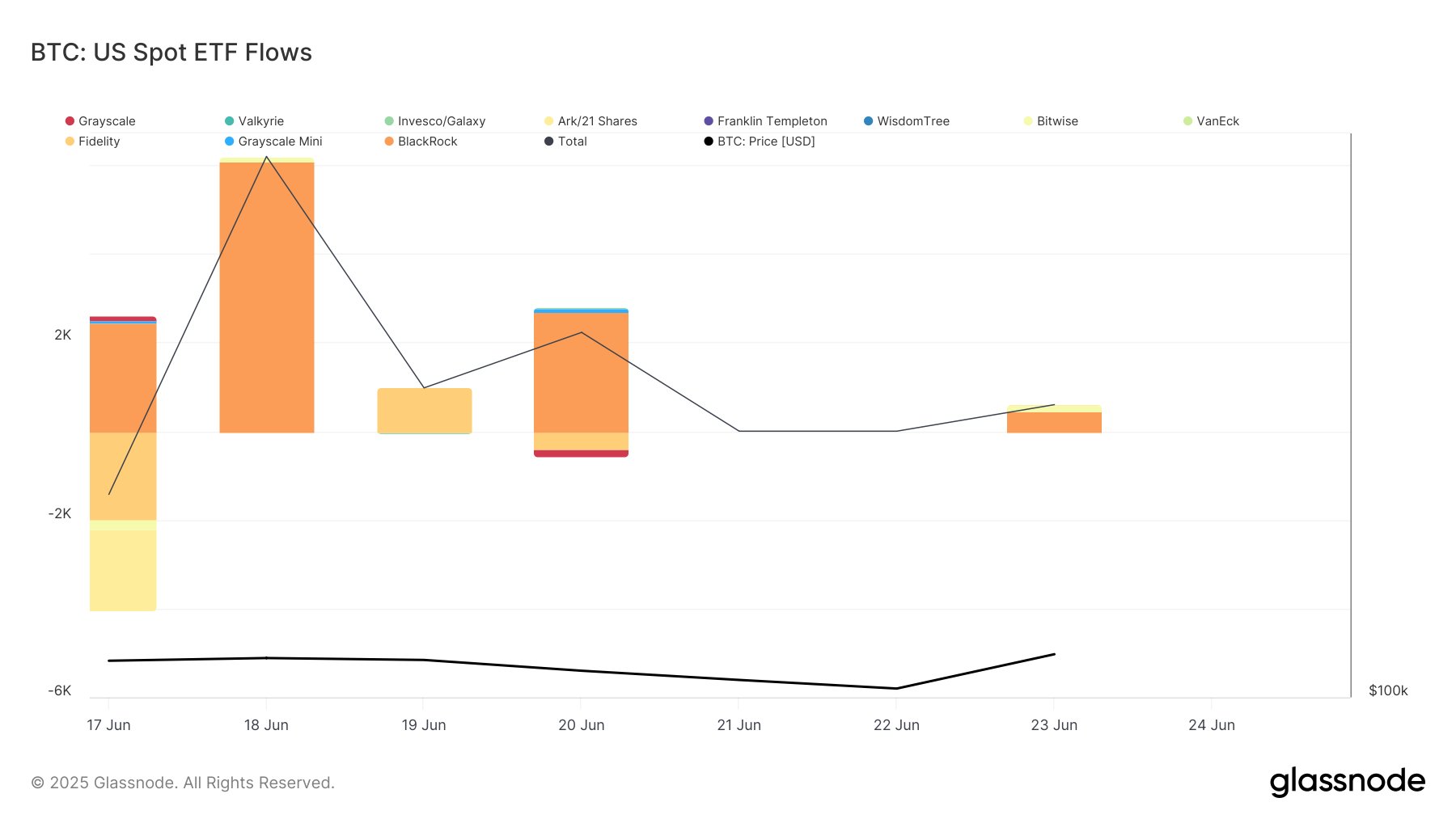

In another information, the US-based Bitcoin spot exchange-traded funds (ETFs) noticed web inflows yesterday, twenty third June, as identified by the analytics agency Glassnode in an X publish.

The information for the netflows related to the US spot ETFs | Supply: Glassnode on X

As displayed within the above graph, the US Bitcoin spot ETFs noticed web inflows of round 598 BTC on this date, regardless of the geopolitical tensions. “Though the inflows have been modest, no main outflows have been recorded both, which is notable sign of investor confidence,” notes Glassnode.

BTC Worth

Bitcoin has already made restoration past the extent it was buying and selling at earlier than the plunge, as its value is now again at $106,000.

The asset appears to have shot up in the course of the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, Different.me, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.