Institutional traders simply prolonged their love affair with Bitcoin ETFs to a ninth consecutive day, even because the post-Juneteenth buying and selling session delivered solely a murmur of exercise. Regardless of a modest $6.37 million internet influx on Friday, the streak underscores how main gamers stay dedicated to on-chain publicity.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise, or different supplies on this web page.

This quiet persistence issues: it indicators that, past retail’s weekend jitters, the large cash nonetheless sees Bitcoin merchandise as dependable automobiles for portfolio diversification. As ETF flows stay constructive, even when summer season buying and selling slows, traders are reminded that institutional assist usually precedes broader market strikes. Given this backdrop, it’s value asking which tokens might journey this wave: right here’s the very best crypto to purchase now.

Bitcoin ETF Inflows Keep Scorching; Ether Funds See First Outflow

Regardless that the world stands on the verge of World Battle III, inflicting upheaval in each the crypto and inventory markets, Bitcoin ETFs have prolonged their successful streak to 9 consecutive days, positioning Bitcoin as a trusted hedge throughout occasions of uncertainty.

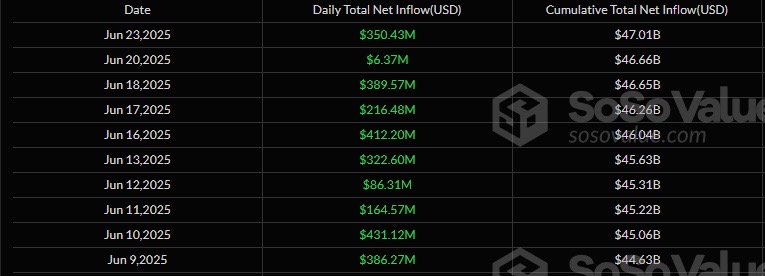

This cautious however regular trickle displays ongoing, if measured, investor confidence. The motion was concentrated: BlackRock’s IBIT dominated once more, pulling in a stable $46.91 million, whereas Constancy’s FBTC noticed an outflow of $40.55 million.

Basically, IBIT single-handedly saved all the Bitcoin ETF market within the inexperienced, offsetting FBTC’s retreat. Regardless of the sunshine quantity, buying and selling held agency at $2.72 billion, although complete internet property dipped barely to $126.54 billion.

On the flip aspect, ether ETFs broke their constructive run, recording an $11 million internet outflow for the day. BlackRock’s ETHA led this shift, marking a notable change in sentiment for these newer funds. So, whereas Bitcoin funds prolonged their inexperienced streak, ether funds hit a bump.

Because the week closed, the market signaled a quick pause in momentum, but Bitcoin’s influx streak stays intact. This persistent move, even after the vacation, is a constructive signal.

Traders are clearly watching situations carefully, and future developments might simply sway flows into each bitcoin and ether ETFs.

In a nutshell, BlackRock’s IBIT continues to be the powerhouse, driving bitcoin ETF inflows and cementing its lead, whereas ether funds confronted their first notable setback. “At this fee $IBIT is destined to be first in flows,” mentioned by Michael Saylor.

Bitcoin Worth Evaluation

The present worth of Bitcoin is buying and selling round $105K, with a market capitalization of roughly $2 trillion. Over the previous few weeks, Bitcoin has been buying and selling in a transparent vary between roughly $100,000 on the draw back and about $107,000 on the upside.

Each time the worth marched up towards $107,000, sellers stepped in with sufficient pressure to push it again down. Nonetheless, on June twenty second, the worth discovered assist on the $100,000 stage and bounced again.

From about June tenth onward, the chart paints an image of a short-term downtrend: successive decrease highs and decrease lows as sellers chipped away at Bitcoin’s worth.

That sequence of decrease swing factors indicators that promoting strain was firmly in management till June twenty third’s massive inexperienced candle, which utterly engulfed the prior day’s crimson physique on excessive quantity.

In buying and selling jargon, that’s known as a bullish engulfing sample, and it usually hints that patrons are preventing again onerous proper at assist.

What comes subsequent shall be telling. If Bitcoin’s worth can maintain above $100,000 once more and push previous latest swing highs, we might see a renewed rally towards the $107,000 resistance zone.

However, a decisive break under $100,000 on heavy quantity would counsel bears are successful and will open the door to decrease ranges.

In easy phrases, proper now the battle strains are drawn: bulls have defended the $100K ground, however they’ll have to comply with by means of to actually shake off the latest downtrend.

Monetary advisor Matthew Dixon has been viewing Bitcoin as evolving from a extremely speculative asset to extra of a retailer of worth.

Let’s take a look at Bitcoin for instance. Within the early days it was HIGHLY speculative and the asset has advanced to be extra of a retailer of worth (ETF, Institutional adoption and many others)

My thesis is, that the early worth historical past will not be related or associated notably to the newest worth…— Matthew Dixon – Veteran Monetary Dealer (@mdtrade) June 24, 2025

Finest Crypto to Purchase Now

With Bitcoin ETF inflows holding robust regardless of a post-holiday lull, the broader market stands at an inflection level. Regular institutional demand usually paves the best way for recent rallies, however nimble tokens can amplify returns. In opposition to this backdrop, we’ve chosen three high-potential cryptocurrencies that leverage in the present day’s momentum as the very best choices to purchase now.

Snorter

As Bitcoin ETFs lengthen their influx streak, highlighting sturdy institutional curiosity, Snorter Token emerges as a meme-powered crypto buying and selling bot, streamlining meme coin trades on Solana and past whereas empowering customers to grab alternatives in a dynamic, evolving market.

Snorter Bot is a brand new competitor within the crypto buying and selling bot area, designed for the fast-paced world of meme coin buying and selling. Leveraging Solana’s blockchain, it executes trades in cut up seconds, serving to customers capitalize on rising tokens immediately.

With its fast execution velocity, Snorter permits merchants to remain forward of the group. Its concentrate on safety can also be a prime precedence, having been audited by SolidProof and Coinsult for added belief.

Wanting forward, Snorter plans to develop past Solana with cross-chain capabilities and governance options. The challenge’s roadmap features a DAO, strengthening its long-term potential.

As highlighted by common crypto YouTuber 99Bitcoins, Snorter Token is poised for important features.

Backed by a rising neighborhood and powerful token economics, Snorter is gaining consideration as a promising crypto presale. It blends enjoyable with utility, and early traction indicators its market potential.

Solaxy

Combining high-speed transactions with a developer-friendly toolkit, Solaxy is positioning itself as an alternative choice to Ethereum, excellent for these in search of alternatives past Bitcoin’s institutional focus.

Solaxy (SOLX), a brand new Layer 2 token on Solana, didn’t simply launch; it soared. Inside two hours of its DEX debut, the token surged 65%, reaching a $76 million market cap, signaling excessive demand.

The presale for Solaxy raised a formidable $58.16 million, defying broader market sentiment. Now dwell on CoinMarketCap, the token guarantees to scale Solana with off-chain processing, modular developer instruments, and excessive scalability.

Solaxy’s Layer 2 mainnet is about to go dwell on July seventh, providing quick, inexpensive transactions with zero downtime throughout excessive visitors. SOLX holders will quickly see the total advantages of its high-speed efficiency.

Moreover, Solaxy’s new multi-chain bridge, powered by Hyperlane, permits seamless interoperability between Solana and Ethereum, with plans for assist throughout different main blockchains quickly.

A significant buzz surrounds Solaxy’s meme coin launchpad, the Igniter Protocol, which goals to outpace Pump.enjoyable.

Finest Pockets Token

With on-chain custody attracting new capital, Finest Pockets Token might generate huge institutional and retail curiosity due to its distinctive ecosystem.

New Web3 options like Finest Pockets are tackling crypto safety challenges head-on, turning into important to the rising digital economic system. With the launch of the $BEST token, the Finest Pockets ecosystem is leveling up.

$BEST offers holders entry to simpler token buying and selling, neighborhood governance, and enhanced staking rewards. It additionally unlocks early entry to unique crypto presales vetted by Finest Pockets’s workforce.

Out there on each the Apple App Retailer and Google Play Retailer, Finest Pockets boasts a 4.2-star ranking and over 29,000 opinions. It has greater than 500,000 downloads on Google Play alone, displaying stable person curiosity.

The presale for $BEST is dwell and has already raised over $13.5 million. Presently priced at $0.025225, presale tokens usually enhance in worth earlier than launch, making it a beautiful alternative for traders.

To hitch the presale, merely go to the Finest Pockets web site, join your pockets, and use the presale widget. It’s a simple, beginner-friendly course of, with extra shopping for choices through financial institution card or ETH/USDT swaps.

Finest Pockets lets customers handle a number of wallets throughout completely different chains, simplifying crypto administration. Bitcoin is already supported, with Solana set to affix quickly, additional increasing its capabilities.

Conclusion

Friday’s knowledge makes one factor clear: Bitcoin ETFs have cemented their position as institutional favorites, extending 9 straight days of inflows at the same time as Ether-linked funds take a breather. This cut up underscores a maturing market the place legacy digital property and rising protocols jostle for capital.

Wanting forward, tokens that mix stable fundamentals with robust neighborhood backing are poised to thrive alongside ETF-driven momentum is essential. By specializing in initiatives that align with substantial cash flows with out chasing fads, traders can refine their portfolio technique. In in the present day’s panorama, this disciplined method highlights the very best cryptocurrencies to purchase now.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, straight or not directly, for any harm or loss prompted or alleged to be attributable to or in reference to use of or reliance on any content material, items or companies talked about.