Ethereum’s on-chain exercise has taken a success over the previous week, as rising geopolitical tensions proceed to rattle investor confidence.

The decline in utilization triggers considerations of additional draw back threat for ETH because the second quarter nears its finish.

Ethereum’s On-Chain Metrics Crumble Beneath Geopolitical Stress

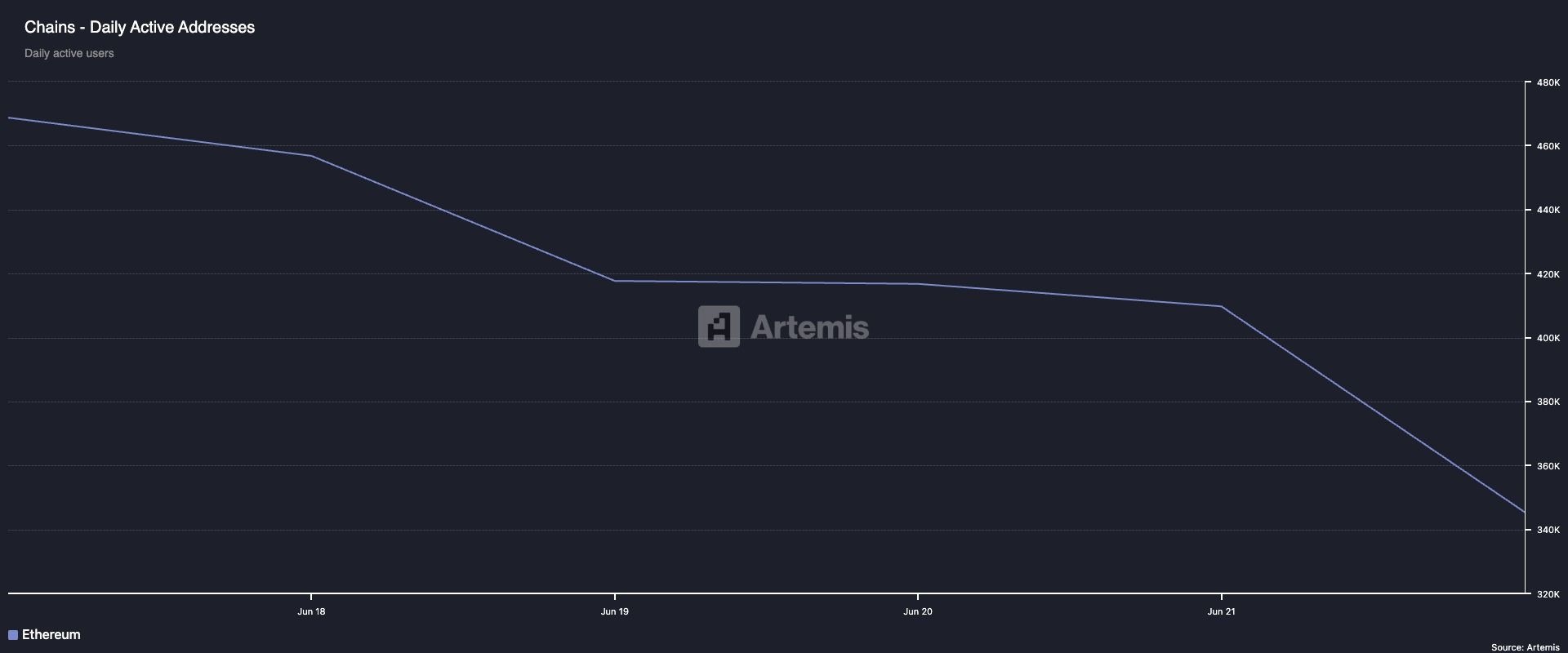

Based on Artemis, the Ethereum community has witnessed a notable dip in consumer exercise over the previous week as pressure escalates between Israel, Iran, and the US. The Layer-1’s (L1) day by day energetic tackle depend has plunged by 26% throughout that interval.

A decline in Ethereum’s day by day energetic tackle depend indicators lowered engagement from customers and builders on the community. It additionally means that fewer wallets are initiating transactions, deploying contracts, or interacting with the decentralized purposes (dApps) on the L1.

This drop in participation typically precedes a broader slowdown in community exercise, mirrored in Ethereum’s transaction depend, which has additionally fallen. Per Artemis, it has dipped by 14% in the course of the evaluate interval.

The decline in consumer engagement is mirrored by Ethereum’s shrinking DeFi TVL. At $57 billion at press time, this has plunged 10% over the previous seven days.

This pullback means that customers are withdrawing funds or avoiding new deployments amid rising uncertainty, limiting liquidity throughout lending platforms, DEXs, and staking protocols.

With fewer transactions happening, demand for ETH declines, dampening worth momentum and contributing to the asset’s current hunch.

Ethereum Eyes $2,569 as Value and Quantity Surge

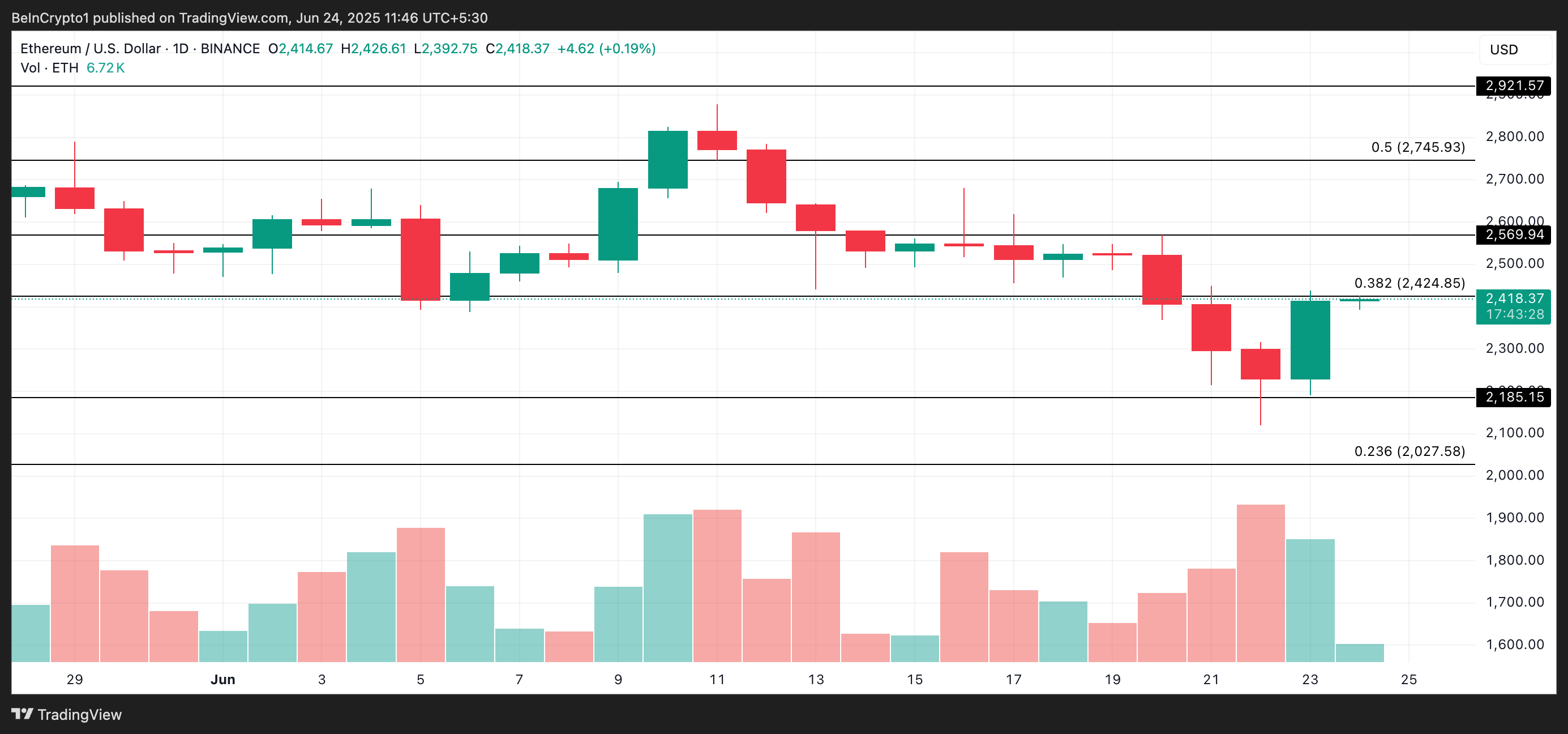

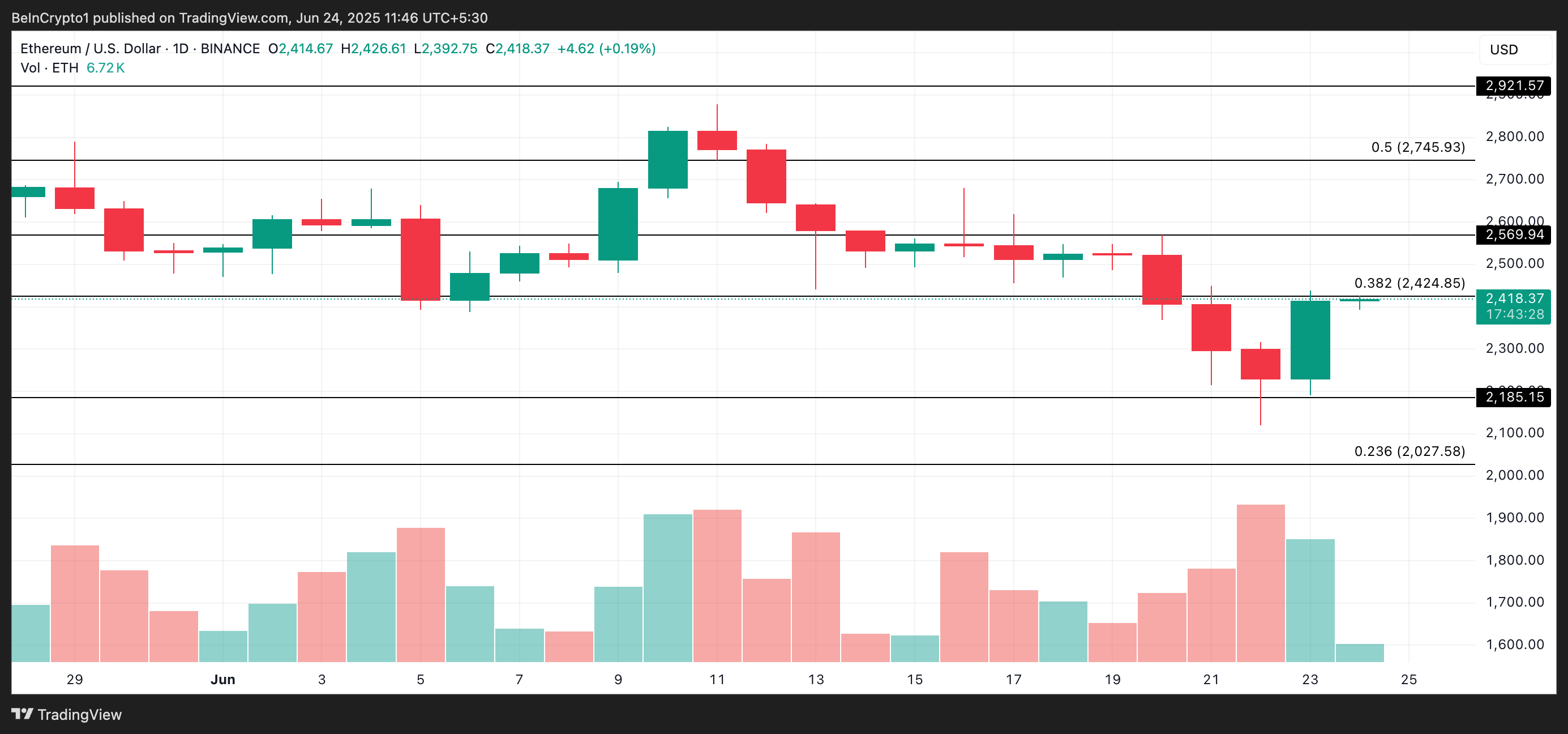

Amid a broader market upswing, ETH has surged 8% over the previous 24 hours, buying and selling at $2,418 on the time of writing. Accompanying this worth leap is a 7% rise in day by day buying and selling quantity, now at $26 billion.

When each worth and buying and selling quantity enhance concurrently, it indicators rising investor confidence and stronger market participation. This implies that actual demand quite than speculative spikes drives ETH’s present worth rally.

If this continues, ETH might breach $2,424 and climb towards $2,569. A profitable break above this worth degree might ship ETH’s worth towards $2,745.

Nevertheless, if selloffs proceed, the coin will resume its decline, and its worth might fall to $2,185.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.