- ETF hype is heating up, with Solana and Litecoin entrance and middle after Bitcoin and Ethereum.

- Bloomberg offers each excessive odds, however Solana has the sting as a result of stronger demand and cleaner belief metrics.

- SEC’s last name remains to be pending—buyers will want persistence because the ETF race performs out.

Crypto markets are nonetheless shaky—geopolitical stress, inflation, you title it. However amid the noise, there’s one query buzzing in investor circles: will Solana or Litecoin get that long-awaited ETF approval first? The SEC’s sitting on practically 100 crypto ETF filings, and yeah… nonetheless no choices this 12 months. The wait drags on. However now, it’s turning right into a showdown: SOL vs LTC.

Why’s Everybody Hyped About These Two?

Up to now, we’ve solely received two spot crypto ETFs—Bitcoin and Ethereum. Each are doing simply fantastic, with inflows climbing and costs holding up. Naturally, buyers are hoping Solana and Litecoin will observe the identical path. In the event that they get listed, that might imply extra demand, extra adoption, and a pleasant value bump. Basic ETF impact.

It’s not nearly chasing income although. Each tokens are huge gamers. And yeah, Ripple followers—your token’s nonetheless within the race too, particularly after Canada rolled out three XRP spot ETFs. However with the SEC and Ripple nonetheless locked in a authorized mudfight, SOL and LTC are the safer bets (not less than for now).

Approval Odds: Who’s Main the Race?

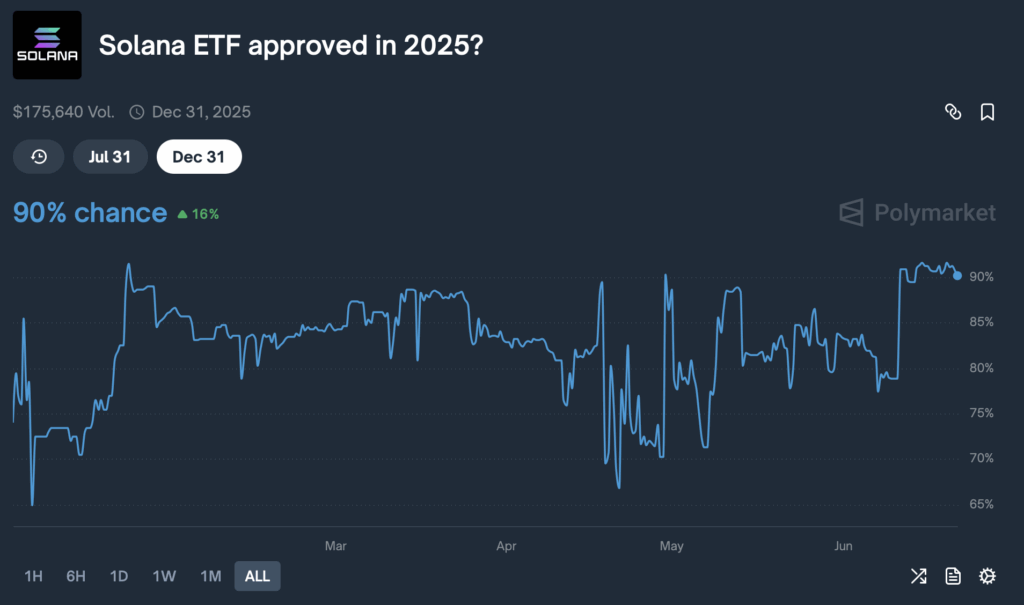

ETF chatter’s been round for years, but it surely’s louder than ever now. Bloomberg analysts not too long ago gave Solana, XRP, and Litecoin a large 95% likelihood of approval. Daring, proper? They mentioned SEC’s latest engagement was “a really optimistic signal,” and the markets jumped on that immediately.

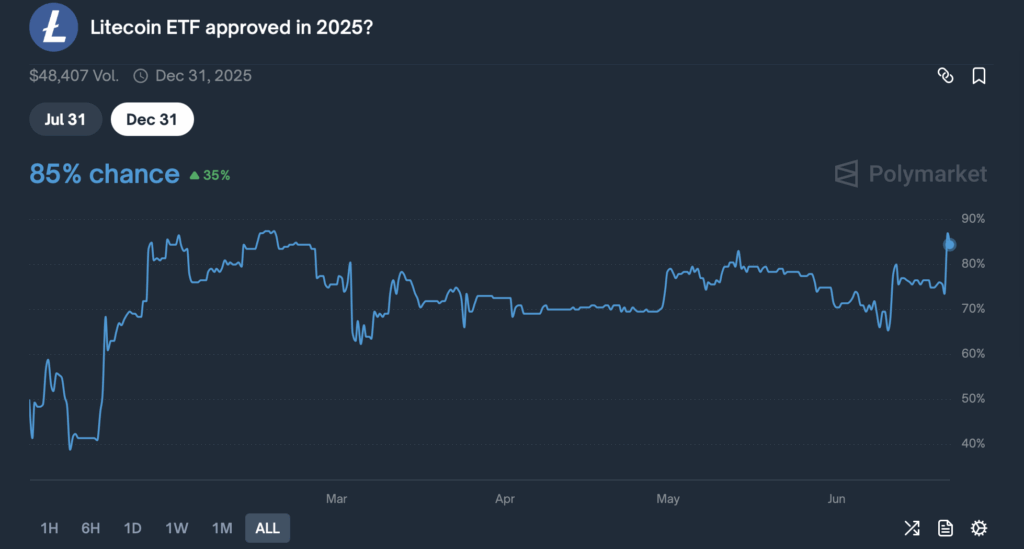

Solana’s ETF odds have been comfortably above 90% for days. Litecoin? Not fairly there. It began gaining steam solely after a kind of Bloomberg updates. Proper now, LTC’s odds sit at 83%, which—whereas not unhealthy—remains to be a couple of steps behind. A part of it comes all the way down to demand. Solana’s received the momentum, whereas Litecoin’s trailing only a bit on that entrance.

Solana May Have the Edge—Right here’s Why

With Gensler stepping down, the SEC’s tone has shifted. They’re exhibiting indicators they would possibly play ball with extra ETF approvals. And between Solana and Litecoin, there’s a noticeable tilt towards Solana. Why? For one, the Solana ETF proposal features a staking function—which is a reasonably large structural change. That alone has of us intrigued.

Additionally, let’s discuss belief funds. The Grayscale Solana Belief holds simply 0.1% of the overall provide. No low cost historical past, minimal disruption threat. In the meantime, the Litecoin belief holds 2.65% and trades at a reduction… which might invite post-approval promote stress. Not precisely ideally suited.

On high of that, Solana has extra filings in entrance of the SEC than Litecoin does. Pair that with stronger adoption and clearer regulatory vibes, and nicely—it could be SOL’s race to lose.

Nonetheless, Nothing’s Assured

As one consumer bluntly put it on X: “What use is there for a Litecoin ETF if the quantity is minimal and the coin’s price $6B? I’d be extra excited if it was price $100B+.” It’s a good level. Litecoin’s stable, however is it large enough to hold an ETF proper now?

So yeah, each SOL and LTC have first rate odds of getting permitted this 12 months. However as with most issues SEC-related—it’s anybody’s guess. Odds are cool, certain. However it’ll all come all the way down to the SEC’s precise choice. Till then, we wait.