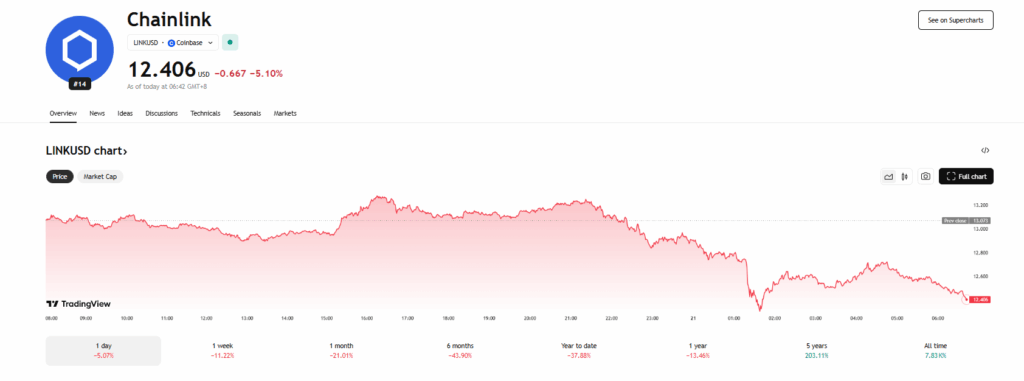

- LINK is down over 20% in 30 days, hovering close to the $12.50 assist stage with bearish sentiment prevailing.

- $16.2 million in change outflows and concentrated lengthy positions trace at potential accumulation.

- Forecasts recommend a gentle short-term rebound, however broader momentum stays weak and unsure.

Chainlink (LINK) has seen its worth tumble over 20% up to now month, presently hovering across the $12.50 mark. This steep drop mirrors broader market weak spot and stems from a mixture of technical breakdowns, liquidations, and unsure sentiment round Chainlink’s latest developments. LINK’s worth stays pinned beneath a descending trendline, with merchants debating whether or not the following transfer is a rebound or one other 20% slide.

Accumulation Indicators Present Hope

Regardless of the bearish tone, some on-chain metrics recommend accumulation is underway. In keeping with CoinGlass, $16.2 million value of LINK has flowed out of exchanges up to now week. This pattern signifies that traders could also be profiting from the dip, decreasing potential promote stress. Lengthy positions are closely concentrated across the $12.55 zone, totaling over $9 million—one other signal of bullish bets regardless of the bearish momentum.

Combined Sentiment Amongst Analysts

Opinions on LINK’s trajectory stay break up throughout the analyst neighborhood. Whereas some warn that failing to carry the $12.50 assist might be disastrous, others consider this zone presents robust upside potential. If LINK rebounds, a return to $14 might ship large wins to these holding lengthy positions. CoinCodex, in the meantime, tasks a modest 3% enhance to $13.20 by mid-July, however flags general sentiment as bearish with the Worry & Greed Index at a impartial 54.

Subsequent Transfer Might Be Pivotal

As LINK teeters at important assist, the approaching days might outline its short-term destiny. A breakout above resistance may rekindle upward momentum, whereas a failure to carry the $12.50 stage could open the door to additional losses. For now, LINK stays on edge, with merchants watching carefully for indicators of both restoration or deeper correction.

Supply hyperlink