- Bitcoin slid to $92,123, erasing all 2025 positive aspects and falling 13% in every week.

- Greater than $335M in BTC liquidations hit the market, with complete crypto liquidations topping $725M.

- BTC is nearing the important thing $92K assist zone, with prediction markets closely favoring a transfer towards $85K.

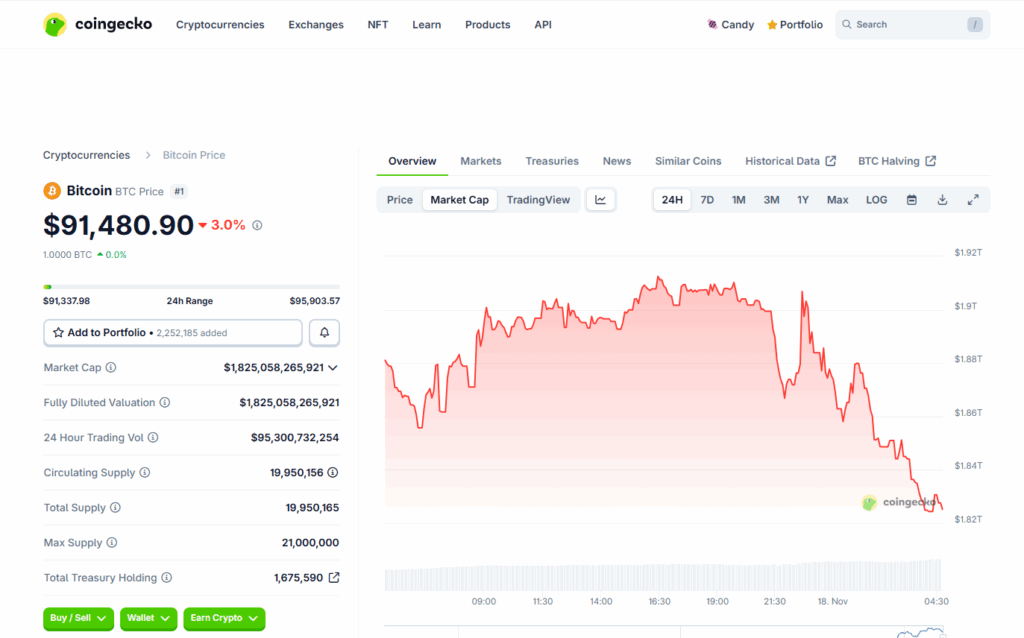

Bitcoin has formally erased all of its 2025 positive aspects, dipping under $93,000 on Monday for the primary time in almost seven months. The benchmark cryptocurrency fell to $92,123 after sliding 2.3% over the previous day and greater than 13% over the past week, based on CoinGecko. The sell-off has been fierce, with buying and selling quantity doubling to $114 billion in simply 24 hours and triggering a wave of liquidations throughout all the crypto market.

Large Liquidations and a Break Under Key Technical Ranges

Roughly $335 million in Bitcoin derivatives have been liquidated within the final day, contributing to $725 million in complete market liquidations. Based on QCP Capital analysts, the break under the 50-week transferring common — together with a weekly shut below $100,000 for the primary time since Might — has cemented a much more cautious tone throughout digital property. In a market the place narratives can form worth motion, the revival of “finish of the four-year cycle” discussions has amplified bearish sentiment.

Traditionally, Bitcoin undergoes a significant correction about 12 to 18 months after every halving. With the April 2024 halving now behind us, BTC has entered that window — and the value motion is lining up with previous cycles. Many analysts beforehand urged the four-year cycle was completed, however the latest downturn is shifting the tone: perhaps it wasn’t over in any respect, simply delayed.

BTC Hovers Close to Essential $92K Assist

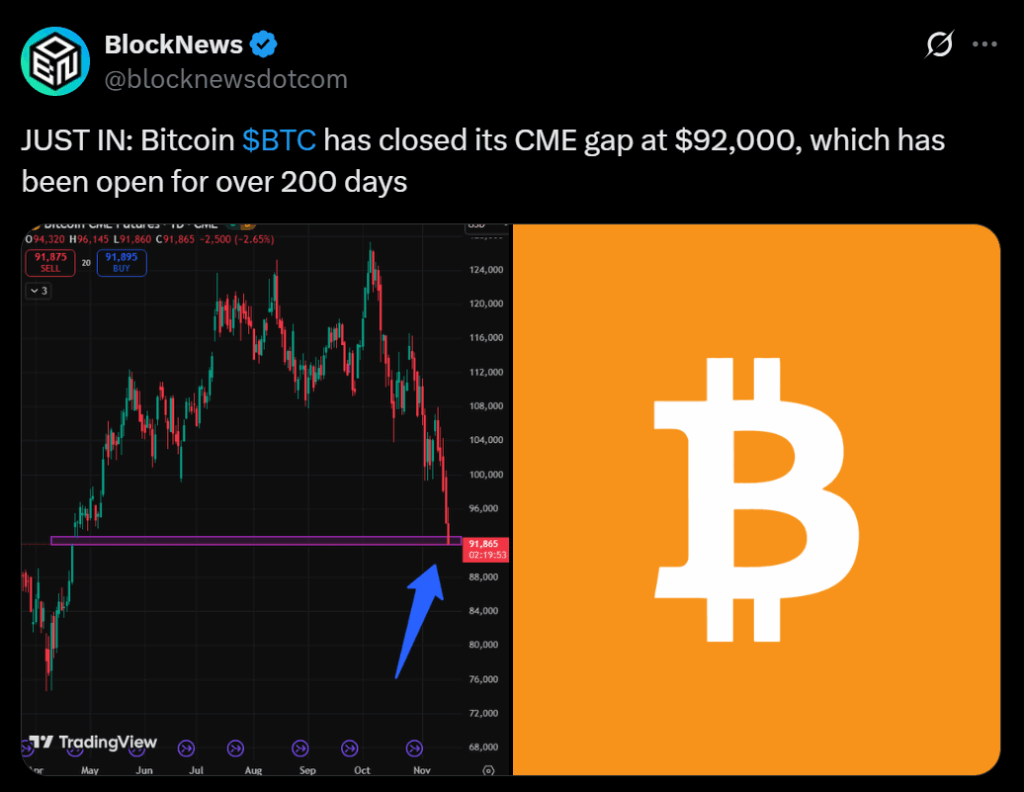

QCP flagged the $92,000 area as a key assist stage. This zone acted as a decrease boundary throughout late 2023 and early 2024, and Bitcoin is now dangerously near testing it once more. The extent additionally traces up with an unfilled CME hole, which may immediate a short-term bounce if tapped. However even when a rebound kinds, QCP warns that overhead resistance stays dense — that means any restoration may very well be capped.

Rising macro uncertainty isn’t serving to both. The U.S. authorities shutdown lastly ended after a report 43 days, however the broader financial image nonetheless feels cloudy. Liquidity has been gradual to return to crypto, and danger urge for food stays weak.

Prediction Markets Flip Bearish: Merchants Count on $85K Earlier than $115K

On Myriad — the prediction platform owned by Decrypt’s father or mother firm, Dastan — merchants are pricing in a steep draw back. Customers now imagine there’s a 63% probability BTC will attain $85,000 earlier than it could possibly climb again to $115,000, a dramatic shift that jumped 30% in simply someday.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.