Trusted Editorial content material, reviewed by main trade specialists and seasoned editors. Advert Disclosure

On Thursday, Bitcoin (BTC) costs dipped to beneath $101,000 as fallout between US President Donald Trump and world’s wealthiest man Elon Musk rocked the US monetary markets. Nevertheless, up to now 48 hours, the maiden cryptocurrency has registered a rebound climbing to above $105,000 earlier than slipping right into a sideways motion. Amidst these developments, a preferred crypto analyst with X pseudonym KillaXBT has outlined a number of eventualities for Bitcoin’s subsequent worth motion.

Behind Bitcoin’s Rebound From $100,000

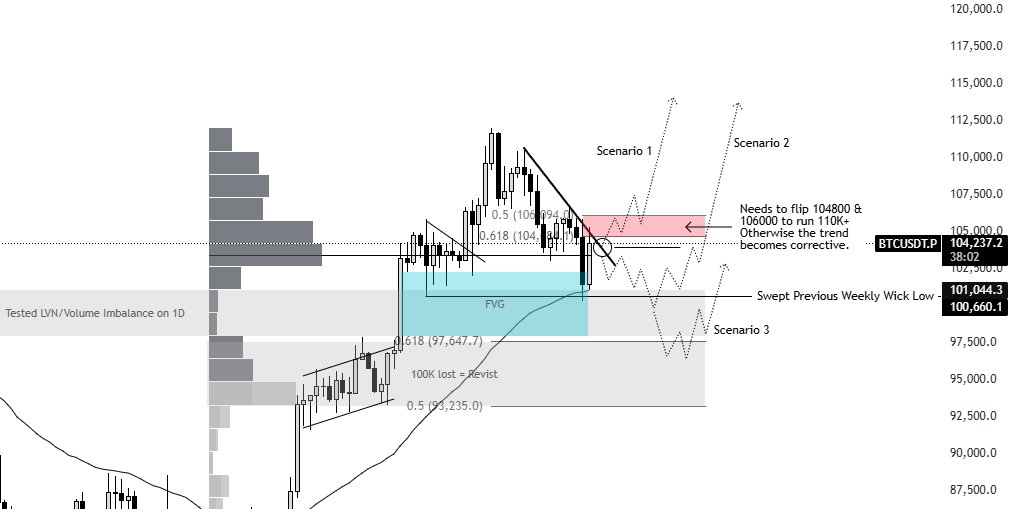

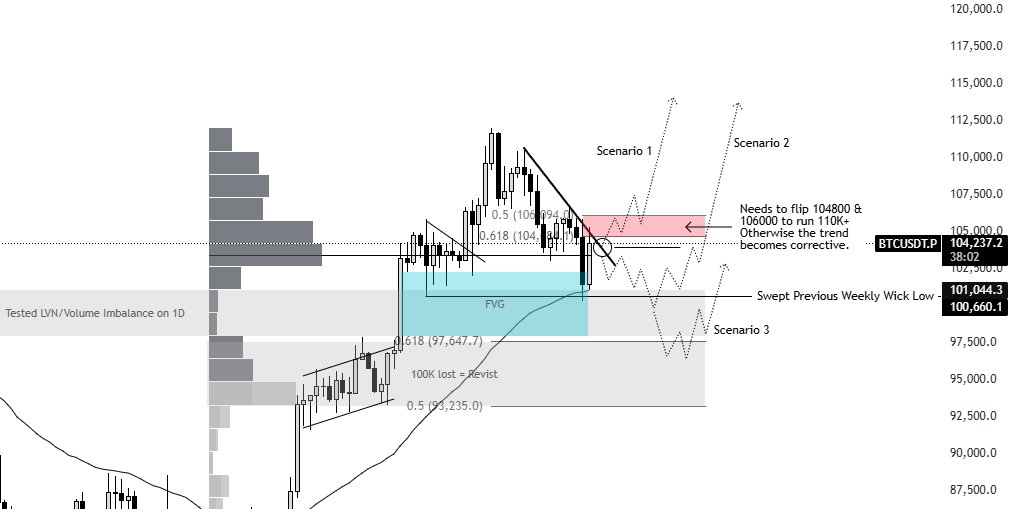

In an X publish on June 7, KillaXBT gives a profound technical evaluation of the Bitcoin market discussing the current worth rebound and potential developments shifting ahead. After reaching a brand new all-time excessive close to $112,000 on Might 22, BTC entered a corrective section falling by an estimated 10% into the $100,000 worth vary, earlier than it’s current rebound up to now two days.

KillaXBT explains this rebound isn’t random and was pushed by a mix of technical and market elements. These elements embody the day by day FVG and quantity imbalances that are worth crammed inefficiencies left behind on the chart.

Moreover, there was a liquidity sweep as Bitcoin’s regular decline pushed costs beneath the earlier weekly lows triggering many stop-losses from lengthy positions. This growth created a flush of liquidity for giant gamers which served as a gas in driving a market rebound.

Lastly, KillaXBT talks on a brief squeeze setup whereby the Bitcoin market turned quick heavy when merchants anticipated an additional draw back following the preliminary worth bounce from $100,000. When costs began going up, these quick merchants had to purchase again to cowl their losses, including extra gas to the rally.

What Subsequent For BTC?

Seeking to the long run, KillaXBT has highlighted three potential eventualities for BTC. Presently, the analysts states the premier cryptocurrency is retesting a resistance zone between $104,800-$106,000 which aligns with the 0.5-0.618 Fibonacci retracement ranges of the current worth drop.

For the primary situation, KillaXBT foresees a bullish continuation provided that Bitcoin breaks and holds above this resistance area. Such a transfer might entice quick sellers as soon as once more, probably fueling additional upside momentum.

Nevertheless, if Bitcoin faces rejection at this specified resistance space, the second situation comes into play, through which the value is prone to decline and retest the $100,000 assist degree. The third, last and worst case situation features a worth break beneath the $100,000 main Bitcoin to retest assist zones across the $97,000 worth area.

Apparently, KillaXBT’s private projection expects market makers to proceed driving Bitcoin’s worth larger, capitalizing on the current sharp rebound that caught many quick merchants off guard. With no clear “protected” lengthy entry but out there, the analyst means that pushing costs additional would entice extra quick sellers whereas forcing sidelined bulls to chase the rally

At press time, BTC continues to commerce at $105,600 reflecting a 1.16% achieve up to now day.

Featured picture from iStock, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.