We’re midway by means of November, and Bitcoin is veering into harmful territory. It’s buying and selling at $95,700 on Saturday, marking a 24.1% decline from its $126,080 all-time excessive (ATH) created on October 6.

Since Bitcoin’s trajectory dictates the broader market’s course, this can be a concern for everybody. BTC has misplaced a vital help degree, and group sentiment has tanked. Few predict a straightforward rebound – however what does the information say?

Is the bull market over, or is that this only a steep correction forward of an uptrend continuation? Our Bitcoin worth prediction solutions all these questions to find out whether or not BTC will bounce within the days forward and, in that case, by how a lot.

However whereas Bitcoin struggled not too long ago, there was an uncommon divergence from Bitcoin Hyper, a Bitcoin Layer 2. Its ongoing token presale has raised $27.6 million, with round $600,000 raised up to now 48 hours. May this be one of the best crypto to purchase now?

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Bitcoin Worth Prediction: The Bear Case

Bitcoin’s worth plunged to a brand new six-month low this weekend, fueled by weakening market sentiment, ETF outflows, and issues surrounding the equities market.

CoinMarketCap’s Concern and Greed Index presently sits in ‘excessive concern’ at 16 factors, a six-point loss in simply the final day. That is the bottom sentiment since April and solely the third time up to now 12 months it has reached excessive concern.

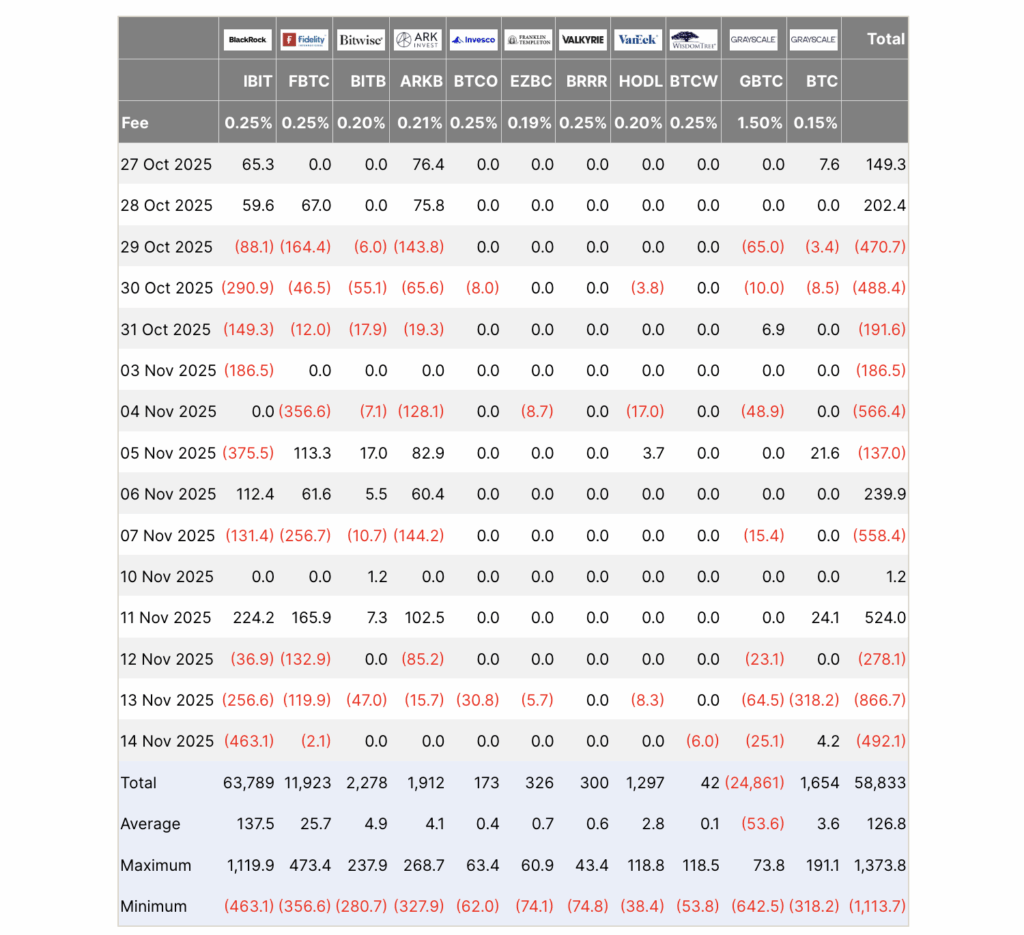

And it’s not simply retail feeling the impact – the biggest Bitcoin funds are closely offloading BTC. Farside Traders’ knowledge exhibits that Bitcoin ETFs recorded $1.5 billion in internet outflows between Wednesday and Friday.

This spot promoting triggered liquidations of leveraged lengthy positions, wiping out $268 million within the final 24 hours, per Coinglass knowledge.

However this isn’t a Bitcoin-only problem. Fairness markets are additionally struggling – significantly tech shares. The tech-heavy Nasdaq Composite slid 2.29% on Thursday as expectations for a December fee reduce fell. Nonetheless, each the Nasdaq and Bitcoin have considerably steadied since, elevating the query:

Is There Gentle on the Finish of the Tunnel?

Most individuals are making ready for a bear cycle, however markets typically transfer within the least predicted course.

The Kobeissi Letter says calls that “the highest is in” have grow to be consensus. It additionally emphasizes that “Excessive Concern sentiment readings have grow to be a day by day incidence,” and that “giant cap expertise shares are down -10% to -20% after working 100%+.”

However it claims these aren’t bear market indicators; reasonably, they’re “hallmark indicators of a technical correction in a broader uptrend.”

Is there the rest supporting Bitcoin’s bull case? Analyst Merijn the Dealer underlines that the availability of BTC on exchanges simply hit its “lowest degree in historical past,” a key indicator of traders taking long-term positions.

BULLISH SIGNAL:

BITCOIN EXCHANGE RESERVES JUST HIT

THE LOWEST LEVEL IN HISTORY.SUPPLY IS DISAPPEARING.

PRICE IS PULLING BACK.THIS COMBO IS EXTREMELY RARE.

WHEN PRICE DROPS WHILE SUPPLY HITS RECORD LOWS…THE PERFECT STORM IS BREWING. pic.twitter.com/laymsrqK9v

— Merlijn The Dealer (@MerlijnTrader) November 15, 2025

Moreover, Bitcoin’s worth chart has began displaying power on the decrease timeframe, bouncing from $94,000 on late Friday to $95,800 on Saturday. Analyst DrBullZeus claims this breaks BTC’s descending construction and lays the best way for a transfer to $102,000 shortly.

OOM! The $BTC downtrend is DEAD.

The chart confirms the breakout from the descending construction. We are actually formally testing the ultimate main resistance on the 0.618 Fib Golden Ratio.

This degree is designed to be damaged in a real development reversal. Flip this into help, and we… pic.twitter.com/u4DFgZZEnQ

— DrBullZeus (@DrBullZeus) November 15, 2025

Let’s face it – Bitcoin has seen higher days. However its close to 17-year observe report has confirmed again and again that it will probably bounce again – oftentimes when folks least anticipate it. The decrease timeframe has began to point out power, and the truth that Bitcoin on exchanges is at report lows is one other nice signal.

Supplied it holds above $96,000 by means of the weekend and into Monday, betting towards Bitcoin at these ranges might show pricey. However even whereas Bitcoin struggled not too long ago, Bitcoin Hyper has defied the percentages and gained great traction – so what does this imply for its future?

Bitcoin Hyper Raises $27.6M Regardless of BTC Decline

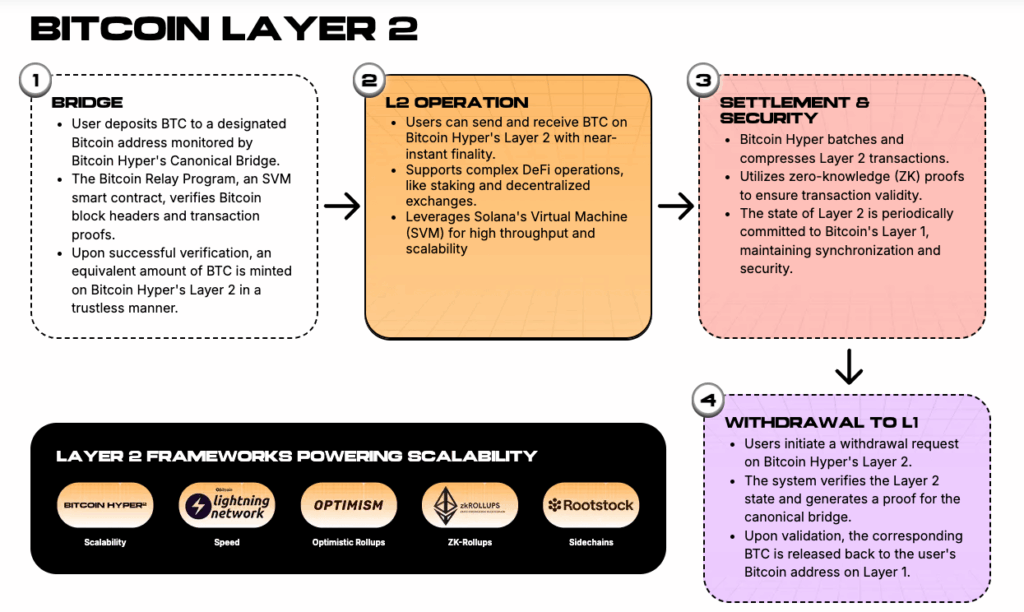

Bitcoin Hyper is doing for Bitcoin what the web did for computer systems. It’s turning an in any other case remoted, single-purpose community right into a programmable ecosystem that helps a variety of use circumstances.

The undertaking is constructing a Bitcoin Layer 2 blockchain that runs on the Solana Digital Machine, enabling it to help good contracts and compute 1000’s of transactions per second (TPS). That’s an enormous leap ahead in comparison with Bitcoin, which might deal with solely seven transactions per second.

With a lot sooner speeds and good contract help, Bitcoin Hyper opens use circumstances corresponding to DeFi, high-frequency funds, stablecoins, meme cash, and AI to decide on the Bitcoin blockchain.

It’s a setup that might basically change how Bitcoin is used – and that’s drawing large curiosity with over $27 million raised within the presale. It’s additionally drawing consideration from analysts, with Alessandro de Crypto not too long ago suggesting it’s going to have “an insane launch.”

Bitcoin Hyper is presently that can be purchased in its early levels by way of a presale, an enormous benefit over Bitcoin, which has pumped exponentially since 2022.

For traders who missed Bitcoin’s 2022 lows, Bitcoin Hyper represents a second probability. It’s one the place everybody can get in on a degree enjoying area, and the place the upside potential is even larger.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, straight or not directly, for any harm or loss triggered or alleged to be attributable to or in reference to use of or reliance on any content material, items or providers talked about.