- Grayscale nonetheless holds 116.8M XLM after accumulating closely earlier than Stellar’s 600% rally, however stopped shopping for in 2025 as XLM fell from $0.52 to $0.26.

- Stellar’s ecosystem is increasing quick, with 37% developer progress and $654M in tokenized RWAs, boosted by the brand new Blockchain Funds Consortium.

- Regardless of sturdy fundamentals, excessive market concern and traditionally weak November efficiency proceed to stress XLM’s value downward.

Stellar hasn’t had a simple run this 12 months. After touching its 2025 peak round $0.52, XLM has now slipped all the way in which right down to the $0.26 vary — mainly slicing its worth in half. And whereas retail sentiment has been drowning in concern towards the tip of the 12 months, smart-money gamers like Grayscale have been quietly adjusting their XLM publicity by the chaos.

Grayscale Nonetheless Holds 116M+ XLM — However Accumulation Has Stopped

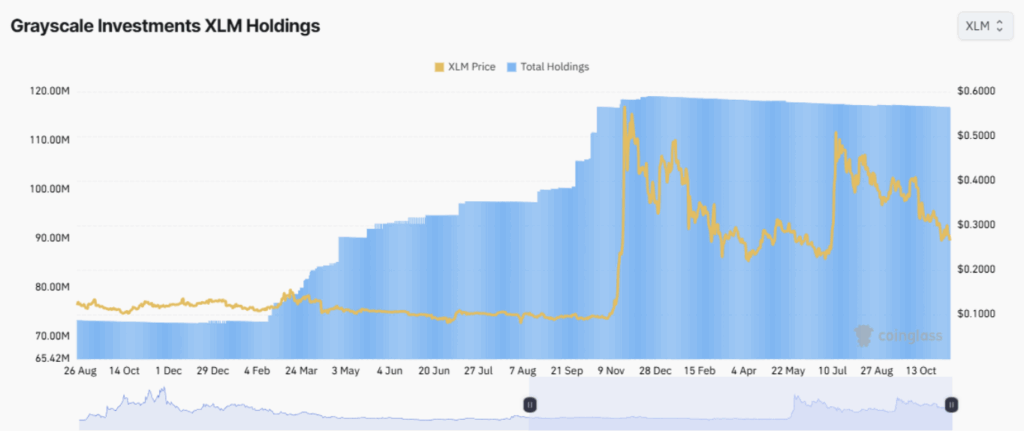

New knowledge from Coinglass exhibits that Grayscale’s XLM technique was spot-on final cycle. Earlier than Stellar printed that monster “god candle” in November 2024 — the one which despatched XLM up almost 600% — the fund amassed aggressively, boosting its holdings from 70 million to 119 million XLM.

It was a kind of textbook smart-money strikes: load up earlier than the explosion, sit again throughout the mania.

However 2025 has been a distinct story. As XLM misplaced steam and stopped setting new highs, Grayscale’s holdings slipped barely to 116.8 million. No large dumping, but in addition no new shopping for. The message appears like: “We nonetheless consider… simply not sufficient to double down on this market.”

Curiously, shares of the Grayscale Stellar Lumens Belief (GXLM) commerce at a 10–15% premium over NAV. Which means traders are actually paying above the underlying worth simply to get publicity — an indication that long-term conviction nonetheless exists, even on this nasty downturn.

However let’s maintain this in perspective: even with over 116M XLM, Grayscale holds simply 0.36% of the circulating 32+ billion provide. That’s nowhere close to sufficient to manage market route, even when they wished to.

Can Stellar Struggle Again In opposition to Heavy Promoting Stress?

Stellar isn’t with out weapons heading into 2026. November 2025 marked a uncommon second of unity in crypto when seven main gamers — together with Solana Basis, Polygon Labs, the TON Basis, Mysten Labs, Fireblocks, and naturally the Stellar Growth Basis — launched the Blockchain Funds Consortium (BPC).

The mission: construct shared requirements for blockchain funds and create actual interoperability throughout ecosystems. For Stellar, a sequence obsessive about borderless worth switch, that is mainly home-field benefit.

Stellar says Q3 additionally introduced 37% progress in full-time builders, outpacing the trade by 8x. The builder momentum appears actual.

In the meantime, the community’s push into Actual-World Belongings is exploding. RWA worth on Stellar hit $654M in November 2025 — greater than double the $300M it had at the beginning of the 12 months. Tokenized merchandise from Franklin Templeton and WisdomTree have been large contributors, pushing Stellar deeper into the regulated-asset lane.

Adoption Is Rising — However Market Sentiment Isn’t

Right here’s the irritating half for XLM holders: fundamentals look higher than ever, however market sentiment doesn’t care proper now. Traditionally, November has been a tough month for Stellar, and this 12 months is not any totally different.

With crypto nonetheless in “excessive concern,” XLM could battle to interrupt out of the broader altcoin downtrend… no less than till the market stops panicking.

The query now isn’t whether or not Stellar is constructing — clearly, it’s — however whether or not the market will truly reward that progress anytime quickly.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.