- BTCS posted a large $65.59M Q3 web earnings, fueled by $73.72M in unrealized Ethereum beneficial properties and report income from its aggressive ETH-first technique.

- The corporate’s Ethereum dividend, loyalty program, and $50M buyback slashed brief curiosity from 5.56M shares to below 1M, whereas whole ETH holdings climbed to 70,322 tokens.

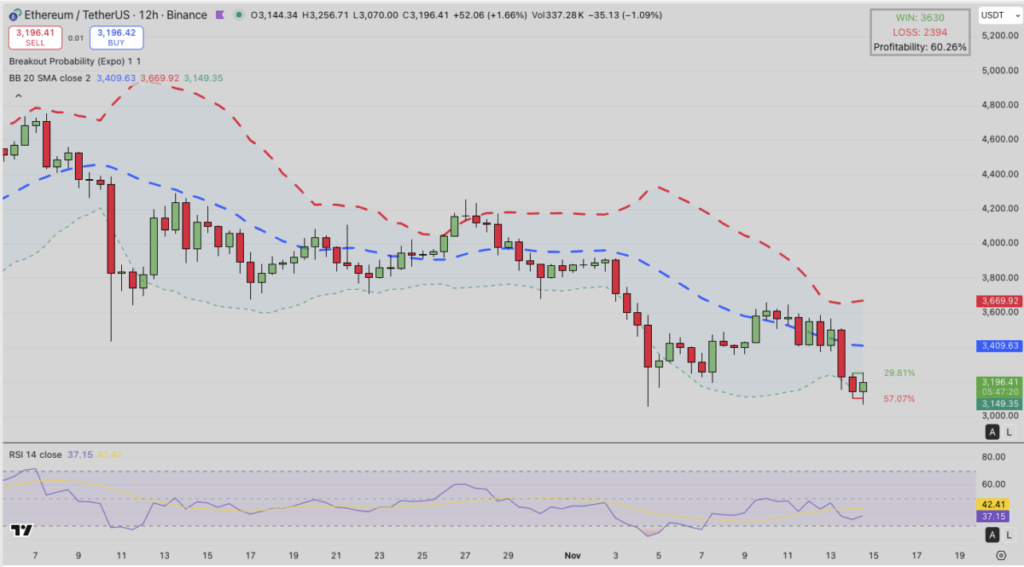

- Ethereum trades close to $3,183 with bearish momentum, and a breakdown beneath $3,146 might ship ETH towards $3,000–$2,900 until bulls reclaim the important thing $3,409 resistance.

BTCS simply delivered the form of quarter most crypto-exposed corporations dream about. The agency posted $4.94 million in Q3 income and a staggering $65.59 million in web earnings, all powered by its aggressive Ethereum-first method — a technique that all of the sudden appears to be like lots smarter than critics as soon as claimed.

Ethereum-Centered Technique Turns BTCS Right into a Heavyweight

Based on the corporate’s submitting, the huge earnings surge was largely fueled by $73.72 million in unrealized beneficial properties as Ethereum climbed sharply all through the quarter. BTCS now holds 70,322 ETH, value roughly $291.58M on the finish of September—making it some of the Ethereum-exposed public corporations within the U.S.

CEO Charles Allen known as the quarter a “defining second,” pointing to a mixture of main strikes: elevating over $200 million, launching a share-repurchase program, and boosting ETH-per-share for traders. Allen stated the outcomes show their “capital-efficient mannequin” is working precisely as meant.

Apparently, BTCS’s income for the primary 9 months of the yr has already hit $9.40M, greater than 2.3x its whole 2024 efficiency. Their pivot towards Ethereum isn’t simply working — it’s rewriting the corporate’s trajectory altogether.

Dividends, Buybacks, and Shrinking Quick Curiosity

One of the vital talked-about catalysts was BTCS issuing the first-ever Ethereum dividend and launching a loyalty reward. The technique didn’t simply appeal to consideration — it crushed brief positions. Quick curiosity dropped from 5.56 million shares to below 1 million in simply two months, forcing bearish merchants to unwind shortly.

The corporate additionally pushed via a $50 million buyback program, scooping up shares at costs round 15% beneath the typical issuance, which additional solidified shareholder worth.

Ethereum Worth Outlook: Can Bulls Regain Management?

Whereas BTCS celebrates, Ethereum itself is wobbling. ETH is presently buying and selling close to $3,183, heading for its third straight dropping session. On the 12-hour chart, candles are urgent in opposition to the decrease Bollinger Band round $3,146, hinting that draw back strain hasn’t totally cooled off but.

The primary main resistance sits on the center Bollinger Band round $3,409. ETH wants a clear breakout above that zone to reset its bullish construction — in any other case, the pattern stays corrective and heavy.

The RSI at 36.51 is deep in bearish territory and nonetheless sliding, however not oversold but. Sellers stay in management for now. If RSI cracks beneath 30, a sharper response bounce might present up, although ETH hasn’t confirmed any reversal alerts simply but.

A decisive candle shut beneath $3,146 would expose a deeper slide into the $3,000 area — the identical zone ETH briefly bounced from in early November. If bulls can reclaim the $3,409 center band, momentum might flip, however till then, the chart leans cautiously downward, even risking a retest of $2,900 if strain builds.

Ethereum is trying to find course, and BTCS’s gigantic ETH stash means they’ll be driving each wave proper alongside the remainder of the market — however with much more to achieve, or lose, than most.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.