Bitcoin (BTC) simply hit its lowest value in six months. After a quick rally final weekend and Monday, the remainder of this week has been crimson. The optimism that traders had has totally evaporated – and BTC has slipped again beneath $100,000 following a brutal sell-off that picked up tempo yesterday.

As a result of newest value motion, the general temper throughout Crypto Twitter has shifted from cautious optimism to real concern. Altcoins are bleeding alongside BTC, and the Crypto Worry & Greed Index has cratered to ranges not seen since late February.

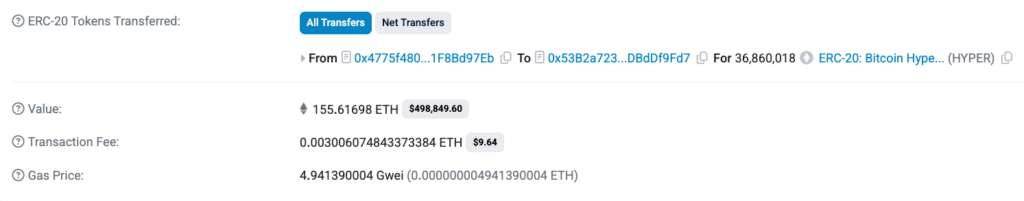

However whereas retail merchants are heading for the exits, crypto whales are quietly investing six-figure sums into the Bitcoin Hyper (HYPER) presale. Yesterday alone, one whale invested $500,000 value of ETH into HYPER.

So, what do these whales know that the broader market doesn’t? Let’s break down what’s driving the continued Bitcoin sell-off – and why a number of the smartest cash in crypto is betting on Bitcoin Hyper as a substitute.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

Bitcoin Drops To Its Lowest Degree Since Spring – Time to Fear?

Bitcoin is down over 9% since Tuesday, and the charts look tough. If this weekend doesn’t ship a miracle, it can mark the third consecutive crimson weekly shut – a streak that’s beginning to rattle even essentially the most affected person Bitcoin maxis.

Group sentiment on CoinMarketCap has shifted to 18% bearish, and open curiosity in BTC perpetual futures has dropped 2%. Meaning merchants are closing their positions fairly than doubling down.

And the harm isn’t remoted to Bitcoin both. Ethereum is down over 9%, XRP has shed 8%, and Chainlink has tumbled 10%. Out of the most important altcoins, solely Zcash and UNUS SED LEO have posted good points up to now day.

It’s a market-wide sell-off, and nothing feels secure proper now. All of the hope surrounding This autumn – which is often crypto’s most bullish interval – has utterly dried up and doesn’t appear to be it can return anytime quickly.

Why Bitcoin Is Tanking So Aggressively

Apparently, there’s no single catalyst behind Bitcoin’s drop. It’s extra like a bunch of smaller issues have all hit without delay. First, the macro surroundings has turned hostile. Bitcoin is behaving extra like a tech inventory than a hedge, and the U.S. authorities shutdown has drained liquidity from the monetary system.

Fewer {dollars} circulating means much less cash getting invested in speculative belongings. Plus, uncertainty round a Fed price reduce in December is making traders involved, because the hope was that cheaper borrowing prices would deliver contemporary capital to crypto.

Lengthy-term holders are promoting exhausting.

~815K BTC bought up to now 30 days, the very best degree since Jan 2024.

With demand contracting, this sell-side strain is weighing on the worth pic.twitter.com/jFODp4ZA1p

— CryptoQuant.com (@cryptoquant_com) November 13, 2025

Provide strain can be constructing. Lengthy-term Bitcoin holders have offloaded round 815,000 BTC up to now 30 days, and spot Bitcoin ETFs noticed $886 million in outflows yesterday alone. That’s a harmful combo: provide creeping up whereas demand fades.

And lastly, dealer sentiment has spiraled. Breaking under $100,000 – a key psychological degree – has triggered one other wave of promoting. Main liquidations accelerated the decline as lengthy positions bought worn out, forcing much more promoting strain into an already fragile market.

Whales Are Investing in Bitcoin Hyper As a substitute as Presale Surges Previous $27.5M Mark

However whereas the market tanks, whales are nonetheless investing in Bitcoin Hyper (HYPER). Yesterday, one whale dropped 155.6 ETH – value just under $500,000 at at the moment’s value – into the HYPER presale. Huge cash like this transferring in throughout a market downturn often indicators conviction.

Whales don’t care about hype; they place early when the risk-reward ratio appears to be like good. Yesterday’s purchase pushed Bitcoin Hyper’s presale previous $27.5 million, with a number of five- and six-figure purchases logged in current weeks.

So, why all of the whale curiosity in Bitcoin Hyper? For these unaware, it’s a brand new Layer-2 community constructed to repair BTC’s core issues: sluggish transactions, excessive charges, and no good contract performance.

It runs on the Solana Digital Machine (SVM) for velocity and bridges on to Bitcoin’s blockchain. Transactions that take 10 minutes on Bitcoin can settle in seconds on Bitcoin Hyper, with charges dropping to only cents. That opens up a world of potentialities – lending, yield farming, meme coin buying and selling – all inside the Bitcoin ecosystem.

The HYPER token powers this Layer-2 setup. You employ it to pay charges, stake for rewards (43% APY), and take part in governance. Proper now, HYPER is on provide for simply $0.013275 in presale – however that value rises once more in in the future, so traders are racing to get entangled whereas they will.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to use of or reliance on any content material, items or providers talked about.