Hyperliquid not too long ago surpassed the commerce quantity of perpetuals alternate dYdX, reaching $1.5 trillion. Regardless of being a a lot newer platform, Hyperliquid’s token buybacks and lack of money incentives have offered long-term stability.

To be honest, Hyperliquid has additionally been concerned in a lot bigger controversies, famously delisting JELLYJELLY in response to a brief squeeze earlier this yr. Nonetheless, the platform has been rebuilding its status and producing excessive quantity.

Hyperliquid Buying and selling Quantity Surpasses dYdX

Hyperliquid, a high-performance L1 buying and selling blockchain, has been having fun with many successes not too long ago. Earlier this month, it captured greater than 60% of the perpetuals buying and selling market, and its HYPE token hit a 3-month excessive shortly afterward.

Yesterday, analysts observed that Hyperliquid’s all-time buying and selling quantity surpassed dYdX, and it reached $1.5 trillion right this moment.

dYdX is a decentralized perpetuals alternate that has been lively for 5 years, whereas Hyperliquid’s platform solely launched in 2023.

Nonetheless, the youthful protocol has overtaken it. After launching its native token in 2021, dYdX started using it to reimburse customers’ buying and selling charges, boosting its volumes. It then constructed neighborhood hype round an off-the-cuff “buying and selling contest” with opponents.

Hyperliquid, however, didn’t depend on dYdX’s incentive technique. After its personal TGE final yr, it managed to build up enormous volumes by means of performance, word-of-mouth, and product high quality.

2024 was a peak yr for crypto perpetuals buying and selling, and the HYPE TGE took benefit of the second. This has apparently proved to be a extra sturdy method.

Moreover, Hyperliquid directs the overwhelming majority of its buying and selling charges to token buybacks, which dYdX solely instituted months later, and to a lesser diploma.

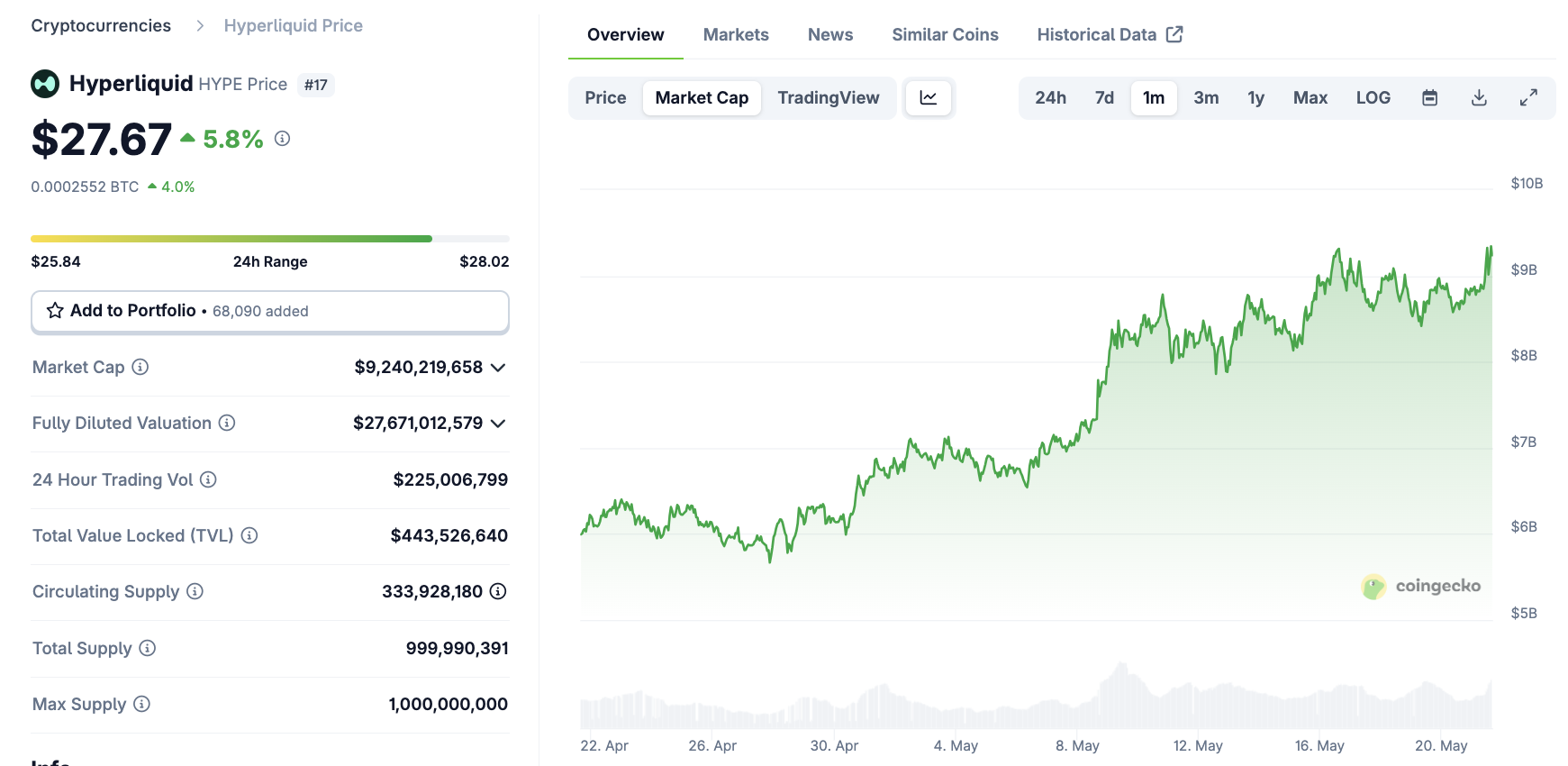

This helped the agency repurchase 17% of the whole circulating HYPE tokens, offering a number of key benefits. Over the past month, HYPE’s market cap has been steadily rising in direction of $10 billion:

Regardless of its sturdy rise, Hyperliquid has additionally seen a number of main controversies. For instance, it denied claims of a Lazarus Group safety breach regardless of clear on-chain proof final yr.

In March 2025, it unleashed a significant scandal when it delisted JELLYJELLY in response to a brief squeeze. This led to accusations of market manipulation and substantial losses.

dYdX hasn’t suffered a public debacle like that in lots of months, however Hyperliquid did act shortly to rebuild its status. To date, this appears to have labored.

Earlier right this moment, Hyperliquid additionally reached a brand new all-time excessive in open curiosity, surpassing $8 billion. If it might keep this momentum, the alternate can construct a commanding lead over DeFi’s perpetuals market.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.