Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

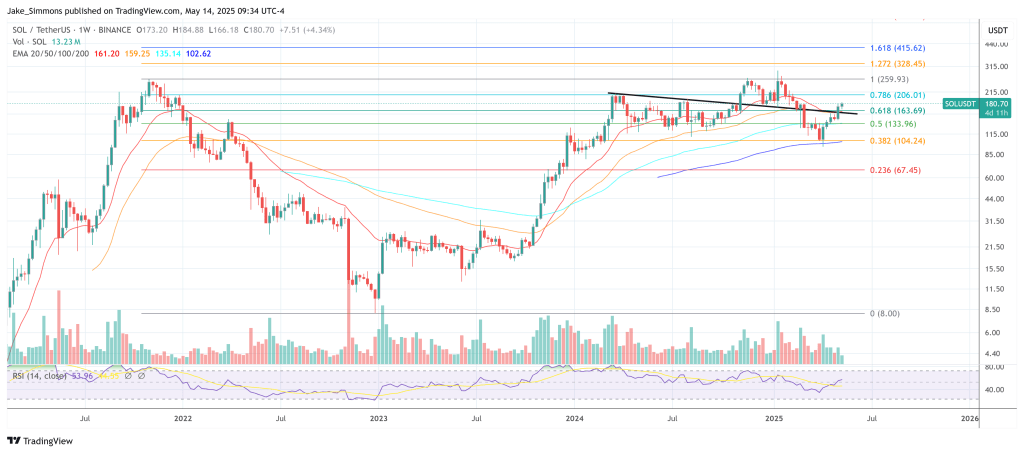

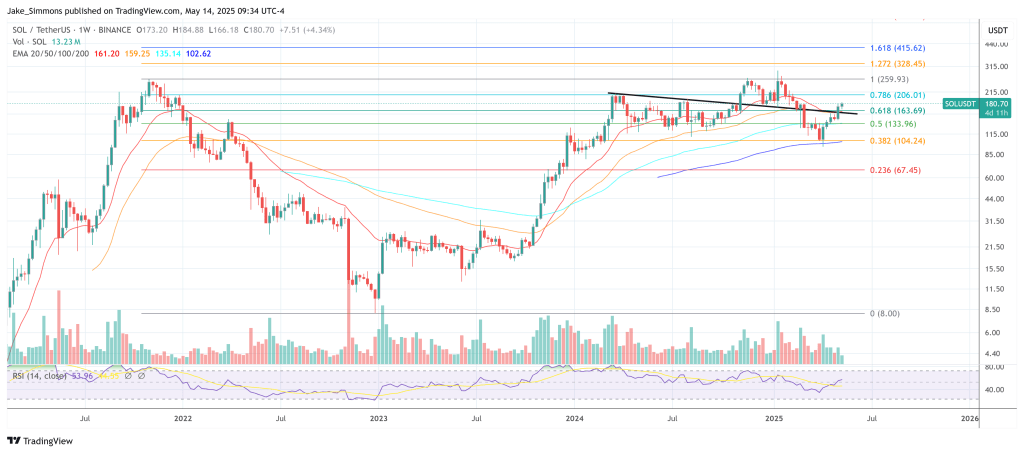

Solana’s native token is extending a formidable Could run that has already carried the market-cap chief amongst non-EVM smart-contract platforms from $146 on the finish of April to as excessive as $18” in Wednesday buying and selling, the best every day shut recorded since mid-February.

In opposition to that backdrop, unbiased analyst Extra Crypto On-line (MCO) launched a contemporary video replace outlining why the transfer is technically “very full however not essentially overextended or overstretched.” Within the clip, MCO reiterates that the advance from the 30 April swing low traces out “a five-wave sample” and stresses that, as a result of “there was no confirmed prime, another excessive was nonetheless seemingly particularly so long as this micro-support space held.” The micro zone he referenced earlier within the week lay between $159.67 and $168.23, a variety Solana examined briefly earlier than powering larger.

Solana May Surge To $360

Zooming in, the channel’s Elliott-wave rely now exhibits 5 clear waves even on what MCO calls “the nano degree,” a configuration that, in classical wave idea, sometimes finishes both an impulsive first wave or the terminating leg of a diagonal.

“If it’s a five-wave transfer, it may be a so-called A-wave,” the analyst explains, which might “end in a B-wave, ideally a better low, after which a C-wave up.” The choice—and MCO’s most popular situation—treats the construction as wave 1 of a a lot bigger impulse that would finally “simply get to $360 or larger.”

Associated Studying

For merchants attempting to calibrate danger within the close to time period, MCO isolates two numbers that matter most. On the upside he names $191.25 as “the subsequent upside degree to observe,” describing it because the 61.8 % extension of waves 1 and three—a textbook Fibonacci goal for a fifth wave.

On the draw back he warns that “it takes a break beneath $172, which is the final swing low, to point {that a} worth prime has fashioned in wave 1.” In a follow-up put up on X he put it much more succinctly: “fifth wave to the upside is confirmed. $191.25 is the subsequent upside degree to observe … it takes a break beneath $172 … to point {that a} worth prime has fashioned.”

Associated Studying

A clear, high-volume break of $191.25 would verify that the speedy corrective danger has been deferred; a decisive every day shut beneath $172 would as an alternative sign that the primary leg of the brand new advance has exhausted itself and {that a} retracement towards the upper-$160s and even the mid-$150s is underway.

As ever, merchants ought to keep in mind that Elliott-wave projections are probabilistic reasonably than predictive. With volatility traditionally elevated in Solana, place sizing—alongside a transparent plan for the 2 technical ranges singled out in at this time’s evaluation—stays the primary line of defence.

At press time, SOL traded at $180.

Featured picture created with DALL.E, chart from TradingView.com