The Ethereum provide on exchanges is on the lowest level in a single yr because the whales proceed accumulating in massive quantities, triggering the bullish investor sentiment and indicating a future improve in costs.

The variety of Ether holdings at massive exchanges has decreased considerably to the bottom level since Might 2024, indicating a serious shift in investor habits and market dynamics.

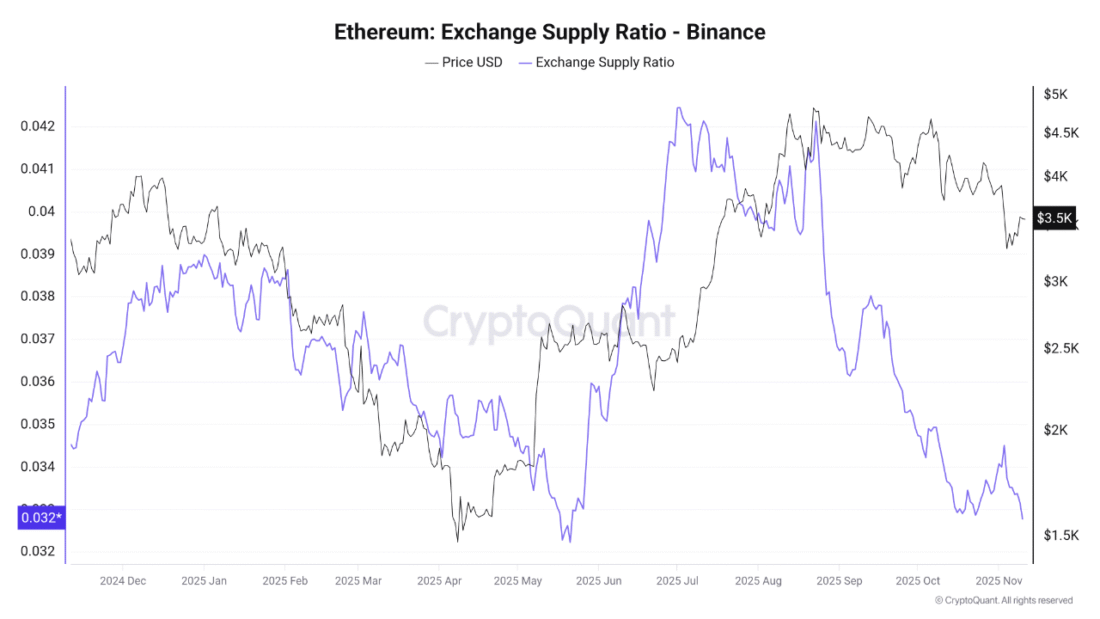

Cryptocurrency analytics on CryptoQuant and Binance point out {that a} constant provide of Ethereum (ETH) is leaving centralized exchanges and, extra particularly, Binance, the most important Ethereum buying and selling website by quantity.

Supply – cryptoquant.com/

This sample pertains to merchants transferring their holdings in non-public or chilly wallets, which could be a optimistic pattern that signifies long-term buy and a scarcity of promoting stress.

Though the worth of Ethereum skilled a downward momentum after reaching its highest level of 4,500 and even 5,000 in mid-2025, the lower in provide on the exchanges confirmed that almost all traders are usually not promoting their ETH, however as an alternative are holding on to them in hopes that they’ll promote them at a later date.

Huge Whale Accumulation Fuels Market Optimism

Whales who personal 10,000 to 100,000 ETH have additionally grown their wallets by about 7.6 million ETH since April 2025, which is a 52 p.c improve.

This buildup goes towards the retail traders, who’ve lowered their publicity, and this is a sign of diverging confidence ranges among the many kinds of traders.

Institutional traders and deep-pocket people have evidently been aggressively positioning themselves in Ethereum, indicating a excessive conviction in its potential in the long run.

One among such main stakeholders is BitMine Immersion Applied sciences, which has just lately bought greater than 110,000 ETH, which incorporates its whole holdings of roughly 3.5 million ETH, price roughly 12.5 billion.

BitMine is focusing on to personal 5 p.c of the general provide of Ethereum, which highlights growing institutional funding.

The chairman of BitMine identified that this continued curiosity is being generated by the higher fundamentals of Ethereum and the upcoming upgrades of the community.

Upgrades and Market Dynamics Underpin Bullish Alerts

The subsequent improve of Ethereum, Fusaka, might be launched in December 2025 and may convey some scalability and effectivity.

This technical growth makes Ethereum higher as a base blockchain for decentralized purposes (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs).

The decrease provide within the exchanges, mixed with the institutional inventory, is basically seen as a stage to be stabilized in worth and a brand new bullish run when the momentum of the market once more picks up.