The Trump administration continues to unveil huge pro-crypto insurance policies, and the most recent one may supercharge the {industry}’s mainstream adoption.

US Treasury Secretary Scott Bessent introduced that the Treasury and IRS have issued new steerage permitting crypto exchange-traded merchandise (ETPs) to stake digital property and share staking rewards with retail traders.

In line with Bessent, this transfer “will increase investor advantages, boosts innovation, and retains America the worldwide chief in digital asset and blockchain expertise.”

Right this moment @USTreasury and the @IRSnews issued new steerage giving crypto exchange-traded merchandise (ETPs) a transparent path to stake digital property and share staking rewards with their retail traders.

This transfer will increase investor advantages, boosts innovation, and retains America the…

— Treasury Secretary Scott Bessent (@SecScottBessent) November 10, 2025

Traders are anticipated to flock to those newly authorized crypto ETFs, as conventional shares don’t supply comparable passive earnings alternatives by staking. This shift may considerably increase each adoption and crypto costs.

Greatest Crypto To Purchase Now: Demand Surges For DeFi Tokens, Excessive-Yield Altcoins

In a serious announcement, the US Treasury and Inside Income Service have made crypto ETF staking authorized.

ETF issuers can now stake the asset below their administration and distribute staking rewards with the traders, eradicating one of many greatest drawbacks of selecting ETFs over direct spot holdings.

The steerage creates a safe-harbour permitting crypto ETP trusts to stake property with out jeopardizing their investment-trust standing.

With staking now tax-recognized and compliant, crypto property that have already got an authorized ETF and supply on-chain staking yields may witness important mainstream adoption.

The transfer may additionally profit DeFi platforms that allow staking, resembling Greatest Pockets, because the legalization of ETF staking is predicted to drive larger curiosity in on-chain yield alternatives.

On this article, we record the 5 finest crypto to purchase now to maximise features from the upcoming staking increase.

Ethereum (ETH)

The ETF staking legalization is predicted to considerably profit Ethereum, additional establishing it among the many finest crypto to purchase now.

Spot Ethereum ETFs have already gained important recognition as an funding, recording almost $13.88 billion in complete inflows since their debut. BlackRock’s ETHA itself has over $13.8 billion in inflows since its launch, information from Farside Traders reveals.

With issuers now allowed to stake the property below their administration, the demand for Ethereum ETFs may skyrocket amongst institutional and mainstream traders.

Distinguished analyst Ted Pillows claims that ETH will catch as much as the worldwide M2 cash provide in This autumn. Citing the institutional bidding from treasury companies like BitMine and the staking approval, he tasks that Ethereum’s honest worth might be within the $8,000 and $10,000 vary by Q1 2026.

$ETH will meet up with the M2 provide in This autumn.

The honest worth of Ethereum is $8,000-$10,000 by Q1 2026.

With institutional bidding and staking approval, I feel ETH will rally onerous. pic.twitter.com/GWhdqetubr

— Ted (@TedPillows) October 13, 2025

Uniswap (UNI)

Uniswap has emerged because the top-performing crypto asset, presently up by over 22% previously 24 hours.

The UNI crypto is presently buying and selling at $8.50, with a market capitalization of over $5.3 billion.

UNI is surging after Uniswap Labs and the Uniswap Basis rolled out the “UNIfication” proposal that may activate a price change, diverting a portion of protocol buying and selling charges into token burns and income sharing for UNI holders.

Whereas the proposal nonetheless awaits formal governance approval, the promise of lowered provide and direct worth seize has ignited investor sentiment and pushed UNI’s value sharply larger.

Having reviewed the deflationary tokenomics, analyst Wajaht Mughal claims that UNI lastly seems to be a beautiful funding to purchase and maintain.

After its explosive rally, the Uniswap value is presently in a pullback, which Nebraskangooner claims may current a wonderful shopping for alternative for sidelined traders. A profitable retest of the 99-day Easy Shifting Common, just under the $8 mark, could be the best “purchase” sign.

https://x.com/Nebraskangooner/standing/1988247976129560930?s=20

Sei (SEI)

Layer-1 token Sei is as soon as once more among the many finest cryptocurrencies to purchase, backed by sturdy upside potential and engaging 4-5% APR staking rewards.

SEI is presently buying and selling at $0.18, up by 14% over the previous week. High crypto analyst Ali Martinez now claims {that a} huge multi-bagger rally is on the horizon.

Martinez claims {that a} purchase sign has been confirmed on Sei. Whereas the token may first pull again to $0.15 to kind a double backside, a 400% bullish reversal to 0.70 is probably going subsequent.

He additionally highlights $0.15 as the best entry level for sidelined traders, or a breakout above the $0.20 mark.

The on-chain exercise continues to be strong on the Sei blockchain, which now has over 100,000 month-to-month lively wallets, the very best amongst any EVM chain.

Greatest Pockets (BEST)

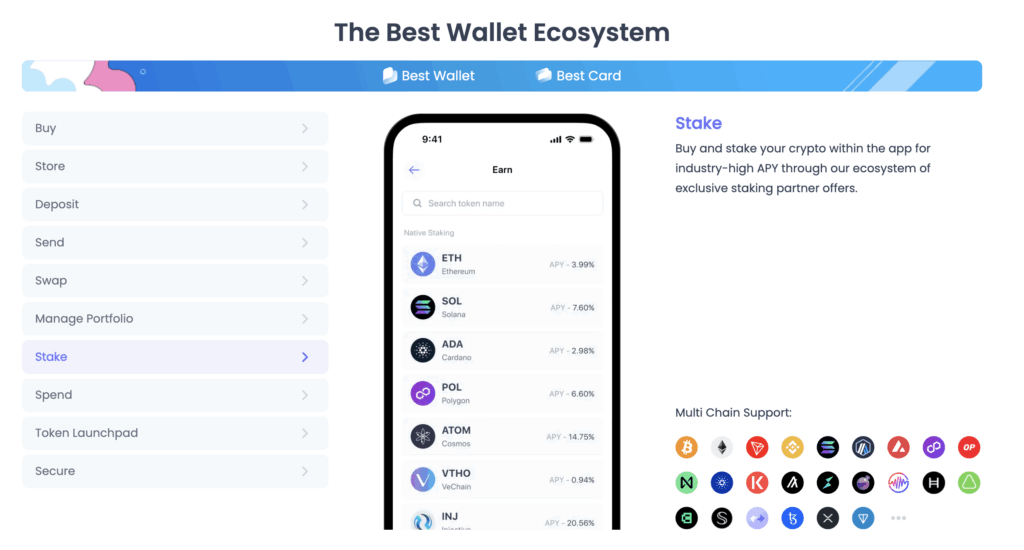

The brand new Greatest Pockets has already grow to be one of many fastest-growing merchandise within the crypto market. Because of its multi-chain, non-custodial, and nameless design, it boasts over 250,000 lively month-to-month customers and a formidable 630% month-on-month surge in app installations.

Scott Bessent’s legalization of ETF staking may now not directly ship a serious increase to Greatest Pockets, positioning it as a key gateway for customers in search of on-chain staking entry.

Notably, Greatest Pockets will quickly launch its staking aggregator, an all-in-one staking function that may permit customers to stake quite a lot of property and earn industry-high yields. These holding the BEST token will qualify for larger APY.

Furthermore, BEST holders can stake their cash within the presale itself and earn a reward fee of over 70% every year, considerably larger than the {industry} common.

With ETF staking now authorized, even traders who don’t maintain these funds will begin searching for on-chain staking alternatives, a pattern that might immediately profit Greatest Pockets.

In addition to, it has different superior options like presale aggregator, derivatives and futures buying and selling, an NFT gallery and extra.

The BEST token has already raised almost $17 million in its presale, which is ending in simply over two weeks. Good cash traders are amongst its early patrons, with many calling it the following 10x crypto.

Bitcoin Hyper (HYPER)

Consultants proceed to again Bitcoin Hyper as the very best crypto to purchase amongst low-caps, owing to the excessive upside potential and profitable 43% staking yield.

For the uninitiated, Bitcoin Hyper is the most recent BTC layer-2 mission, designed to deal with the efficiency and scalability points related to Bitcoin.

Powered by the Solana Digital Machine and zero-knowledge structure, it goals to ship the efficiency of contemporary blockchains throughout the Bitcoin ecosystem.

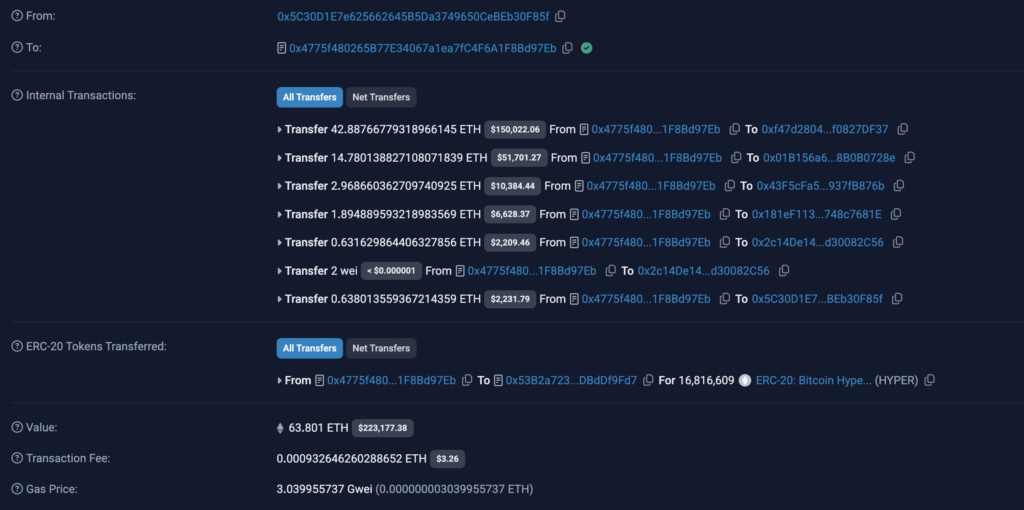

The HYPER token is on the core of the ecosystem, which explains its sturdy whale demand. As an example, a whale pockets swapped 63 ETH for HYPER, investing over $223k into the brand new crypto. That is simply the most recent in a string of six-figure buys from whale traders.

Layer-2 cash are likely to have excessive upside potential, with one other BTC layer-2 coin, Stacks (STX), reaching a peak market cap of $5 billion.

Unsurprisingly, a low-cap like Bitcoin Hyper is being considered by prime analysts as the following 10x crypto.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t liable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to use of or reliance on any content material, items or providers talked about.