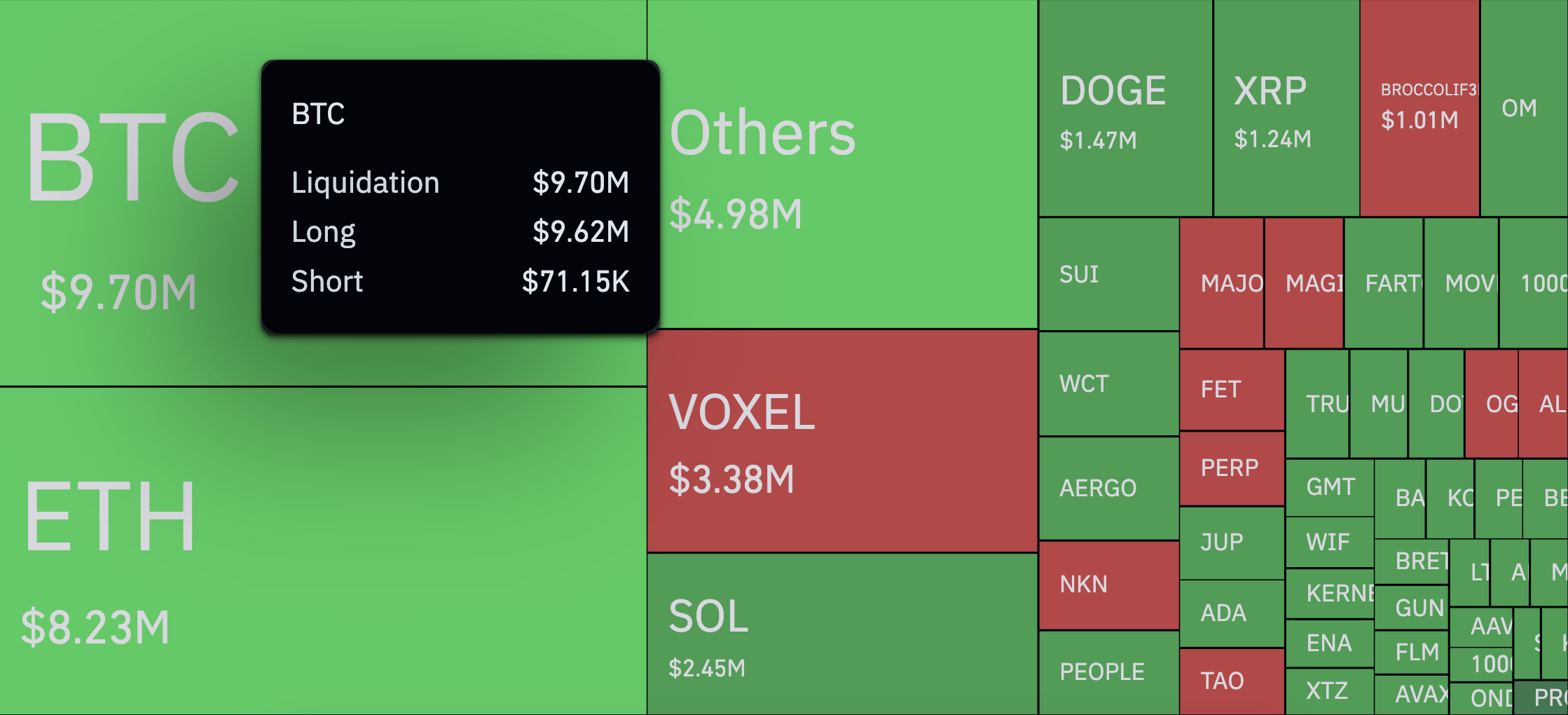

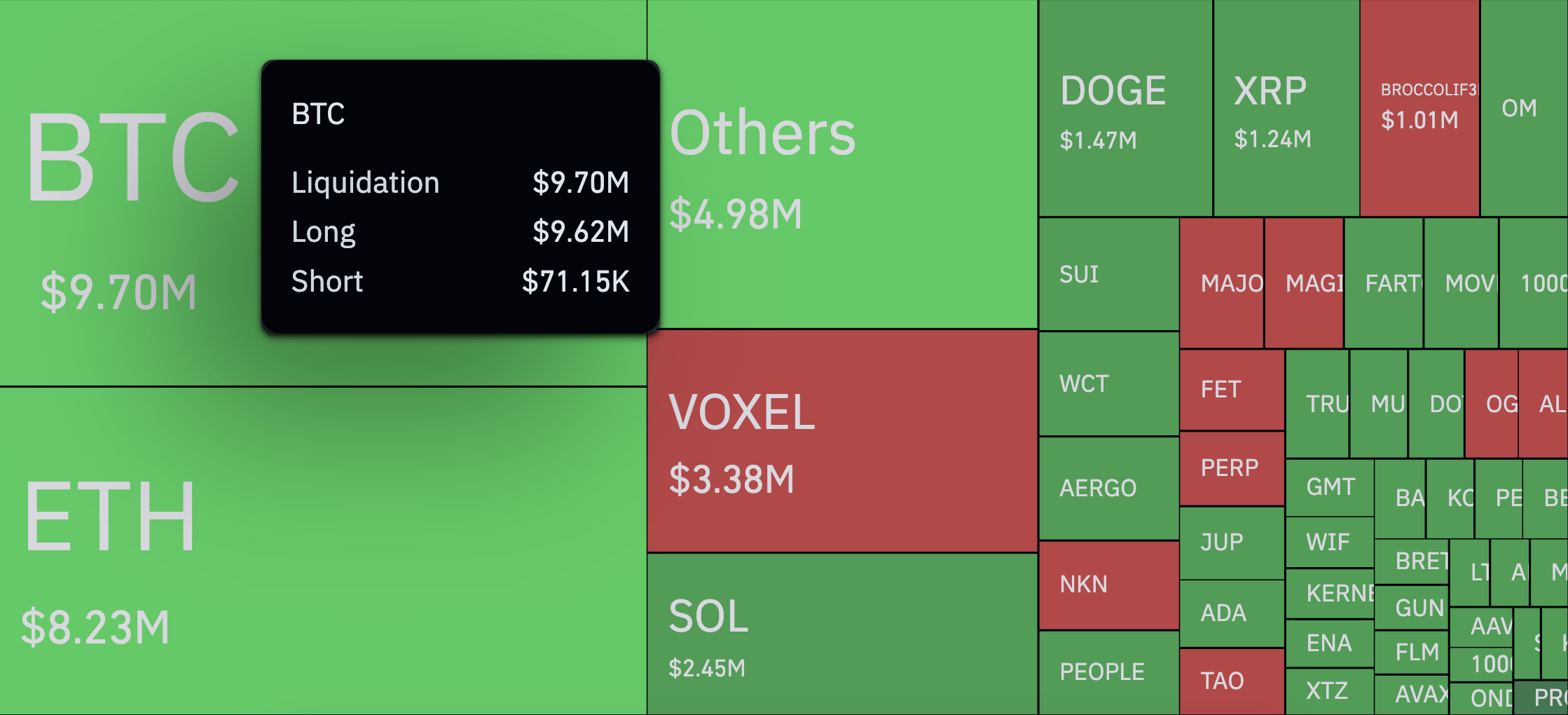

It is not the form of Easter shock merchants have been hoping for, as over the previous 4 hours, Bitcoin (BTC) has seen a large 13,520% long-to-short liquidation imbalance, with $9.62 million in longs worn out in comparison with simply $71,000 in shorts. The transfer got here amid a pointy drop within the worth of BTC to lows close to $83,800 earlier than a light bounce to the present stage of $84,453.

The sell-off triggered a complete liquidation of $35.35 million throughout the market in the identical four-hour window, with 83.6% of the injury coming from longs.

BTC alone accounted for the most important chunk at $9.7 million, adopted by ETH at $8.2 million and SOL with $2.45 million in liquidated leverage.

The magnitude of the imbalance speaks for itself. Whereas lengthy liquidations are frequent in speedy pullbacks, this type of one-way flush — over 130 instances extra lengthy positions have been liquidated than shorts — reveals simply how uncovered the market had develop into heading into the weekend. The volatility was sufficient to drive a complete of $165.1 million in liquidations over the past 24 hours, affecting over 119,000 merchants.

The largest single liquidation order? A $5.95 million BTC/USDC place on Binance, in keeping with CoinGlass.

For those who have a look at Bitcoin’s worth chart, you will notice that the transfer was steep however fast. After spending a while at round $85,400, Bitcoin took a dip and hit a low of about $83,800. The fast reversal factors to short-term overselling, however the injury to overleveraged lengthy positions was already achieved.

Merchants got here into Easter Sunday considering the market was going to go up. What they bought was a brutal reminder: When everybody goes the identical manner, even somewhat push within the different path can result in a complete wipeout.

Supply hyperlink