Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

The stablecoin market recorded its strongest quarterly expansion since 2021, with $41 billion in net inflows during the third quarter of 2025.

According to Orbital’s Stablecoin Retail Payments Index, retail adoption of stablecoins has entered a new phase of stability after a year of intense growth, owing to the fact that the crypto industry is moving from speculative trading to practical, everyday use in emerging economies.

Retail Activity Settles As Crypto Market Finds Its Balance

Stablecoin activity has begun to level out following a 69% increase in user adoption between mid-2024 and mid-2025. According to the latest report data from Orbital, there were about 3.6 million daily active users in Q3, indicating that the market is stabilizing following the excitement of previous months.

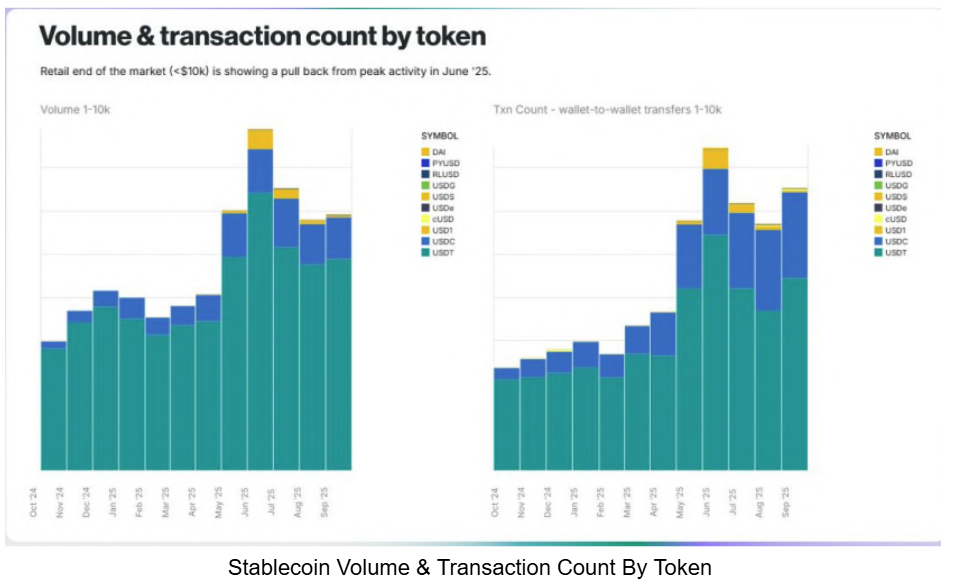

However, the important thing is that retail payment volumes nonetheless climbed somewhat, up 4% to $1.77 trillion, even as the number of transactions declined slightly from 1.33 billion to 1.21 billion. This trend points to larger, more significant transfers replacing the smaller ones below $10,000 that prevailed in previous quarters.

Tether’s flagship token, USDT, continues to dominate the retail industry, accounting for 83% of total transactions. On the other hand, USDC is the favorite token among DeFi users, accounting for more than 50% of the DeFi market. In terms of crypto exchange, Binance plays the major role of controlling much of the liquidity for both tokens and providing the rails for retail payments across emerging markets.

Emerging Markets Lean On Stablecoins To Fight Inflation

Stablecoins are increasingly being used as lifelines in struggling economies. This trend has been acknowledged by financial experts, with Ark Invest CEO Cathie Wood recently revising her $1.5 million Bitcoin prediction due to the growing popularity of stablecoins.

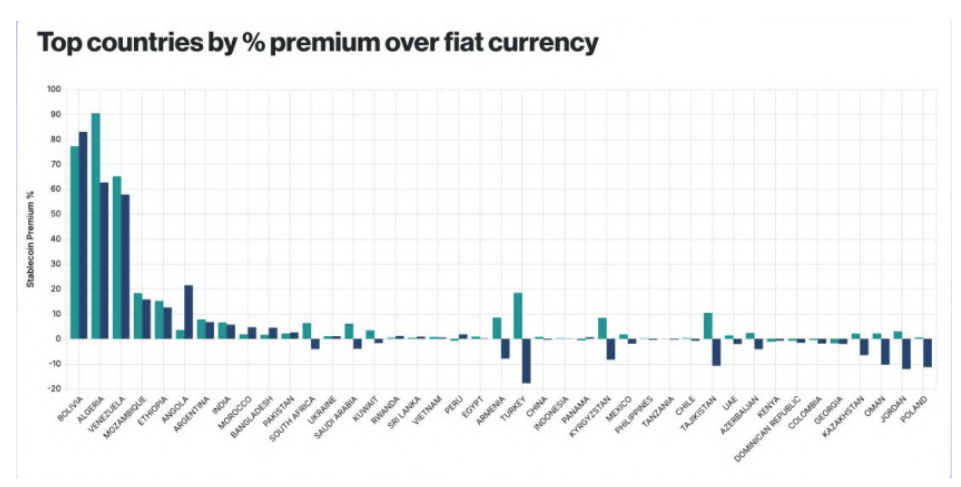

Orbital’s report shows that users in Algeria, Bolivia, and Venezuela are paying staggering premiums of 90%, 77%, and 63%, respectively, to access dollar-pegged tokens. This is a sign that stablecoins are becoming digital versions of the US dollar in these regions. Mid-tier premier ranges between 8% and 18% in countries like Türkiye, Ethiopia, and Argentina.

On the other hand, markets such as India, Saudi Arabia, and South Africa show lower premiums, as improved financial infrastructure makes it easier to buy and sell stablecoins at near-market rates. Some countries, including Colombia and Peru, even trade below parity, a sign of stronger liquidity and growing market maturity.

Top countries by stablecoin premium.

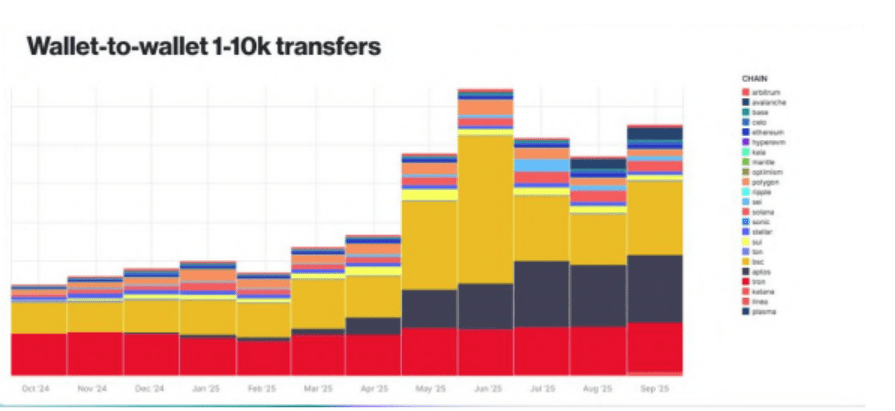

Notably, a new generation of blockchains is competing for a share of stablecoin traffic. Binance Smart Chain still leads in retail transfers but saw growth slow by half in Q3.

Aptos has now stabilized after its massive breakout earlier in the year, while Plasma, the newest entrant, set a record of $7 billion in deposits within days of launching its native token, XPL.

Tron also continued its steady climb due to its heavy USDT usage, and Ethereum saw its total stablecoin supply expand by $35 billion.

Stablecoin Wallet-to-wallet Transfers

According to data from CoinGecko, the stablecoin market cap today is around $311 billion.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.