After greater than a yr of relentless capital inflows, the once-surging tide of crypto liquidity is lastly starting to calm.

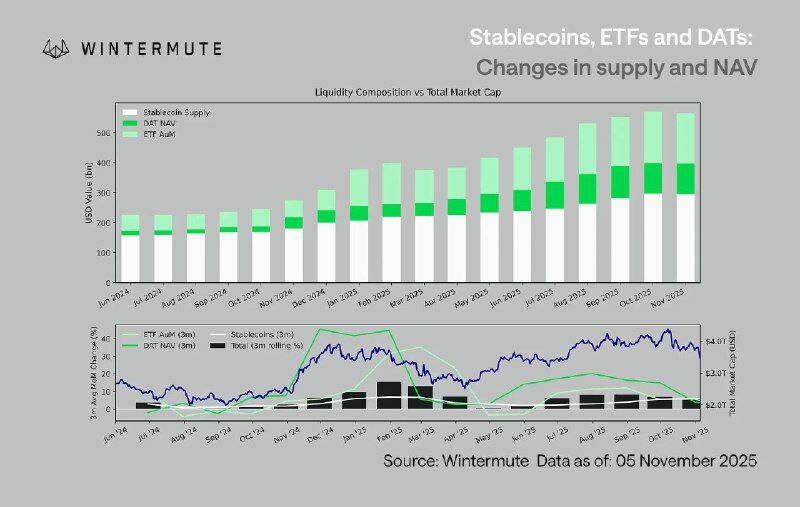

New analysis from Wintermute reveals that the overall worth locked in stablecoins, exchange-traded funds, and digital asset trusts has ballooned from roughly $180 billion in 2024 to about $560 billion by November 2025 – a staggering threefold bounce. But the newest knowledge hints that this explosive enlargement could also be hitting a plateau.

All through late 2024 and the primary half of 2025, capital poured into the sector as establishments embraced onchain belongings and recent ETF choices. Stablecoins resembling USDT, USDC, and PayPal’s PYUSD anchored buying and selling exercise, whereas spot Bitcoin and Ethereum ETFs injected unprecedented depth into digital markets. On the identical time, tokenized treasuries and personal crypto funds helped bridge the hole between decentralized finance and conventional establishments, pushing whole digital liquidity previous the half-trillion mark for the primary time in historical past.

However that livid tempo of progress has cooled in latest months. Since August 2025, Wintermute notes, ETF inflows have flattened, stablecoin minting has slowed, and digital belief merchandise have seen extra modest enlargement. Analysts hyperlink the slowdown to a shift towards tighter financial situations, widespread profit-taking, and a pause in investor threat urge for food after months of bullish sentiment. The leveling of key liquidity metrics means that the market might have already reached a short-term peak earlier than its subsequent cycle.

The large query now’s the place the following wave of capital will emerge. Some observers count on tokenized U.S. Treasuries and real-world-asset ETFs to guide the following part of progress, whereas others see alternatives in layer-2 settlement tokens and cross-chain stablecoin protocols.

Even with the latest cooldown, Wintermute’s knowledge factors to a stronger basis than in earlier cycles. Stablecoins stay deeply embedded in market infrastructure, ETF merchandise proceed attracting institutional demand, and tokenized belongings are steadily reshaping the hyperlink between crypto and conventional finance. If 2024 and 2025 have been about constructing liquidity, the following stage might decide how successfully that liquidity fuels real-world utility and long-term market resilience.

Supply hyperlink