Trusted Editorial content material, reviewed by main business specialists and seasoned editors. Advert Disclosure

Bitcoin is as soon as once more testing investor conviction because it struggles to reclaim the $90,000 stage, a value zone that has now change into a transparent psychological and structural barrier. After weeks of uneven value motion and repeated failures to maintain upside momentum, sentiment throughout the market has shifted sharply.

Concern and apathy are more and more dominant, with a rising variety of analysts and individuals starting to name for a broader bear market. For a lot of traders, the narrative has modified from shopping for dips to questioning whether or not the cycle has already peaked.

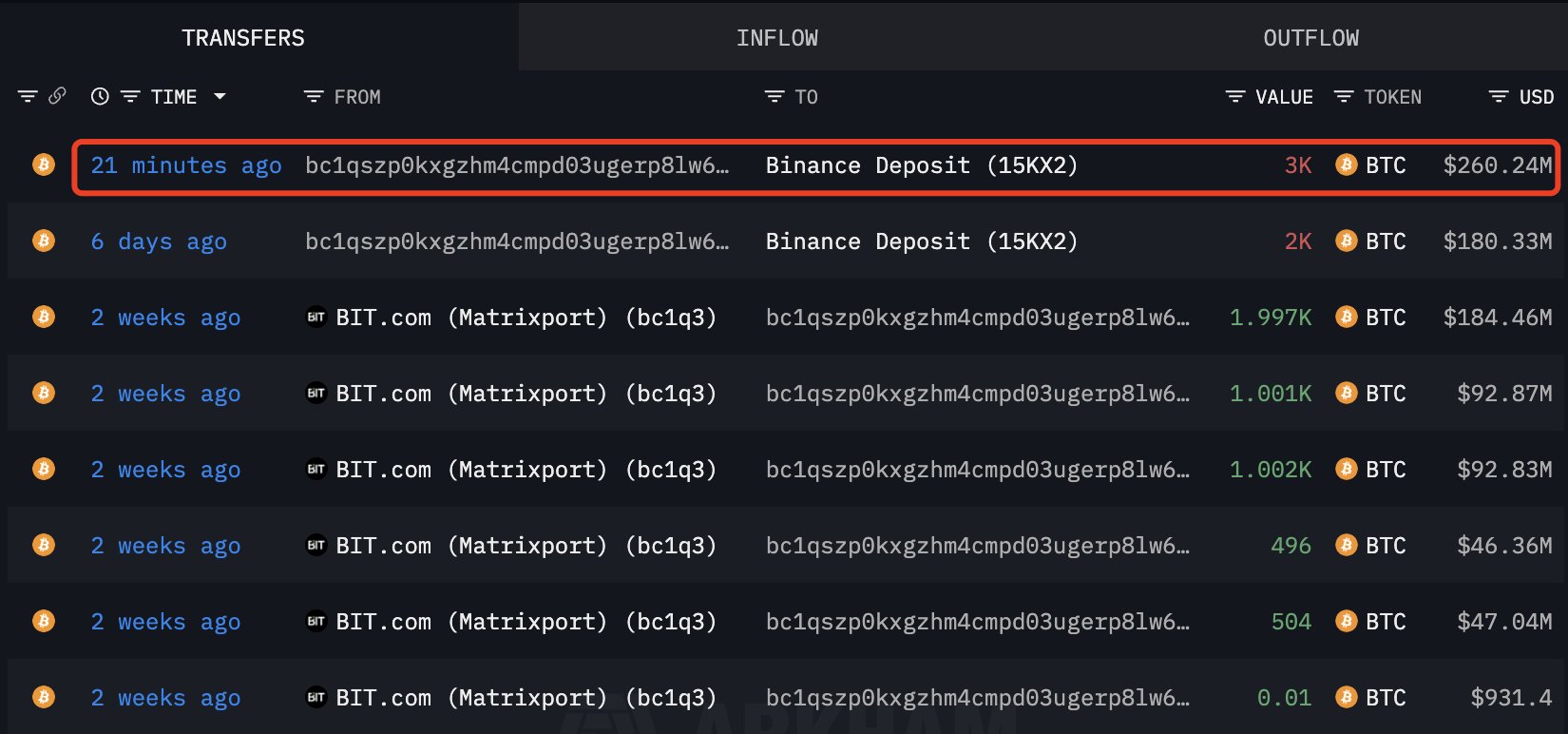

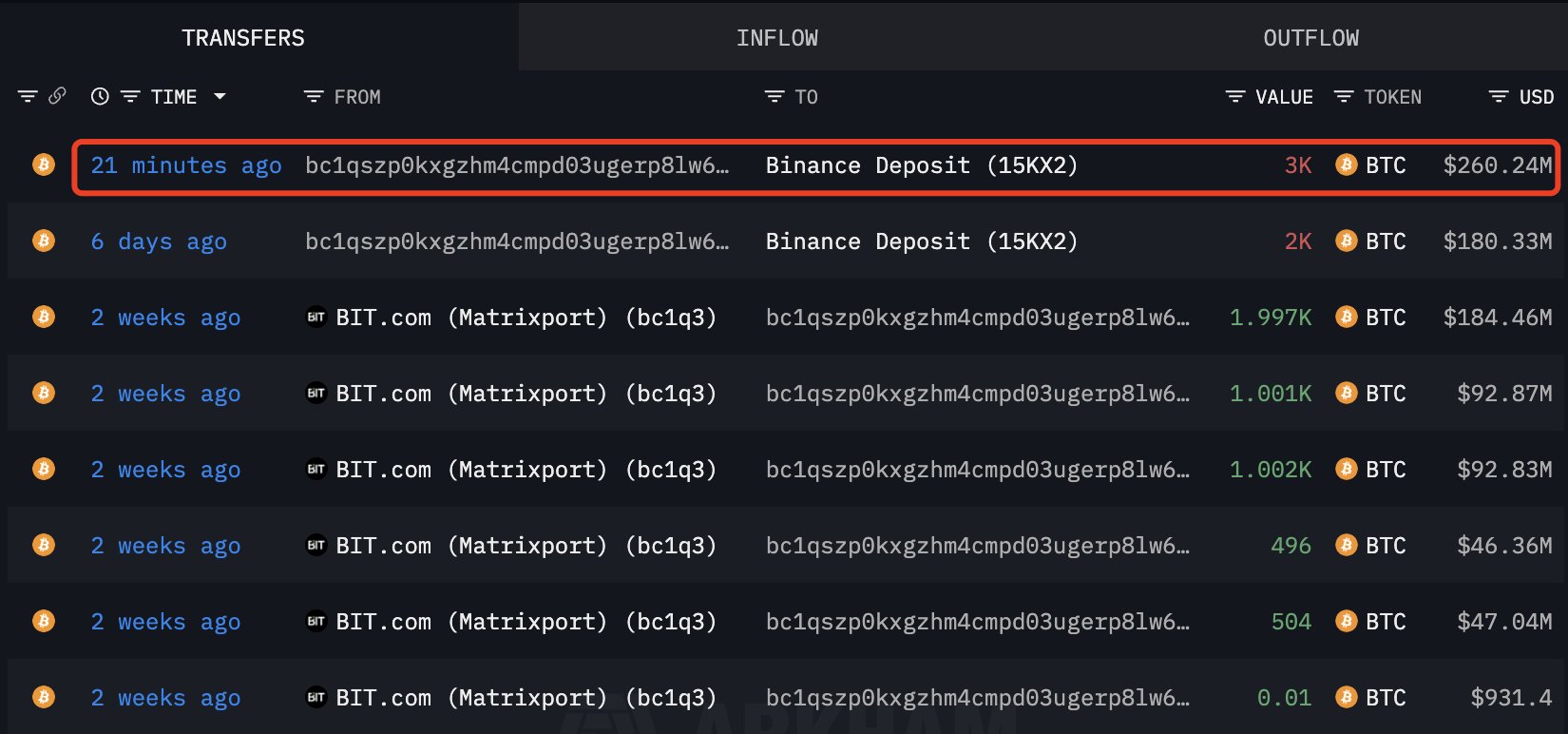

This deterioration in confidence is happening alongside renewed promoting stress from massive, well-capitalized gamers. In keeping with information from Arkham, two wallets linked to Matrixport deposited a mixed 4,000 BTC, price roughly $347.56 million, into Binance in the present day.

Matrixport is a big digital-asset monetary companies platform based by former Bitmain executives, providing merchandise together with crypto lending, structured merchandise, asset administration, and custody options.

Such massive inflows to exchanges are carefully watched by the market, as they usually precede distribution or hedging exercise, notably during times of heightened uncertainty. Whereas not each deposit interprets straight into spot promoting, the timing of those transfers provides to the rising sense of warning.

Whether or not present demand can take up this provide and stabilize value will seemingly decide if this section turns into a deeper correction—or the beginning of a extra extended bearish regime.

Change Inflows And What They Imply For Bitcoin

Giant Bitcoin deposits to exchanges are virtually at all times interpreted by the market as a bearish sign, since they enhance the speedy provide out there on the market. In most historic instances, sharp spikes in trade inflows have preceded durations of draw back volatility, reinforcing the notion that whales are making ready to distribute into liquidity. Nevertheless, some traders urge warning when studying this information in isolation, as not each trade switch ends in spot promoting.

In sure eventualities, massive inflows may be linked to inner treasury administration, collateral rotation, or the opening of hedged derivatives positions relatively than outright liquidation. Establishments could transfer Bitcoin to centralized venues to put up margin for futures or choices, permitting them to hedge draw back danger with out promoting their underlying holdings.

In different instances, funds put together liquidity for over-the-counter settlements or cross-exchange arbitrage, actions that don’t essentially translate into sustained promoting stress on the spot market.

Trying forward, Bitcoin’s value motion over the approaching months will seemingly rely on whether or not these inflows are adopted by a transparent enhance in realized promoting quantity. If demand continues to soak up provide close to the $85K–$86K zone, the market might transition into a protracted consolidation section, permitting sentiment to reset.

Nevertheless, if trade balances proceed to rise alongside weakening spot demand, draw back dangers stay elevated. In that state of affairs, Bitcoin could revisit decrease help ranges earlier than any sturdy restoration can start.

Value Exams Essential Lengthy-Time period Assist

Bitcoin’s higher-timeframe construction reveals a transparent lack of momentum after failing to carry above prior highs. On the weekly chart, BTC is now consolidating across the $86,000–$87,000 zone after a pointy rejection from the $110,000–$120,000 area. This space has change into a important demand zone, as value is at the moment hovering close to the rising 200-day shifting common, which traditionally acts as a key development filter throughout cycle transitions.

The short-term construction stays fragile. Bitcoin is buying and selling beneath the 50-week shifting common, which has began to roll over, signaling weakening upside momentum. In the meantime, the 100-week shifting common remains to be trending larger and sits beneath the present value, suggesting that the broader macro development has not absolutely damaged however is clearly beneath stress.

From a price-action perspective, BTC is forming a decrease excessive relative to the earlier cycle peak, whereas volatility stays compressed. This usually precedes a bigger directional transfer. If bulls fail to defend the $85,000 help decisively, the following draw back targets sit close to the $78,000–$80,000 area, the place earlier consolidation occurred.

Conversely, any structural restoration would require a reclaim and weekly shut above $90,000, adopted by sustained acceptance above the 50-week common.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.