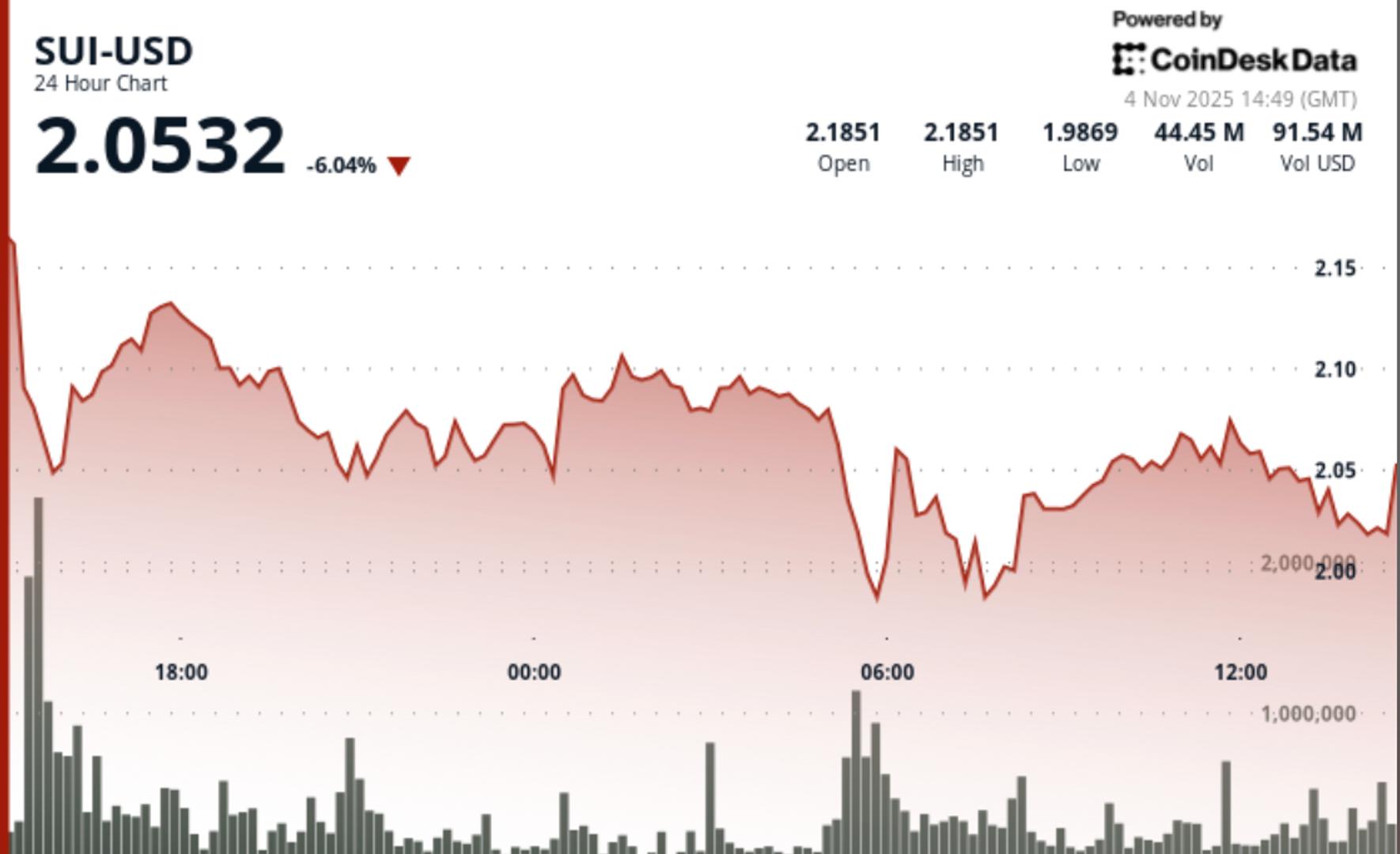

SUI, the native token of the Sui blockchain, fell Tuesday after breaching essential help ranges and triggering a wave of technical promoting. The token dropped 9.2% to as little as $2.02 as buying and selling quantity spiked and restoration makes an attempt repeatedly failed.

The sell-off adopted Monday’s information of a $116 million exploit involving decentralized finance (DeFi) protocol Balancer, which has rattled sentiment throughout the business.

As safety issues mounted, buyers appeared to unwind publicity to riskier layer-1 tokens, with SUI displaying indicators of institutional liquidation, in keeping with CoinDesk Analysis’s technical evaluation mannequin. Almost 42.6 million tokens modified palms in the course of the breakdown, 68% greater than the every day common, in keeping with on-chain information.

The $2.08 stage — as soon as a help zone — flipped into resistance in the course of the rout, with a number of failed bounces reinforcing the bearish development. Throughout U.S. morning hours, SUI hovered round $2.02 in low-volume buying and selling, suggesting merchants had been positioning forward of the following main transfer.

Chart watchers famous basic capitulation habits: a single-hour collapse, adopted by decrease highs and tight consolidation. If the token breaks under $2.014, technical targets level towards $1.98 and even $1.95. To regain momentum, bulls would wish to reclaim $2.07 with conviction.

The CoinDesk 5 Index of the most important cryptocurrencies dropped 1.15% on the day with all constituents decrease.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.

Supply hyperlink