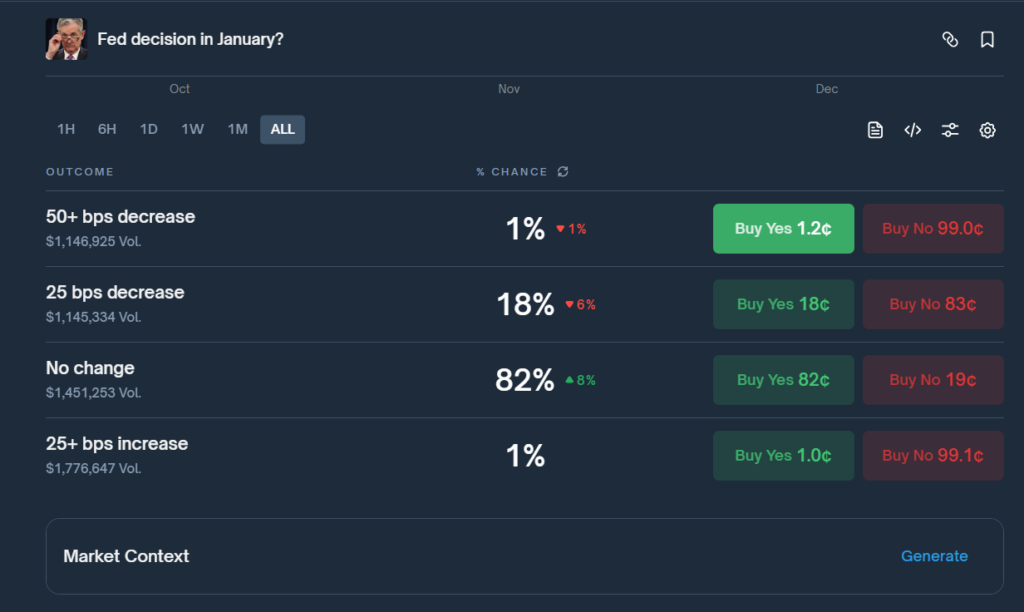

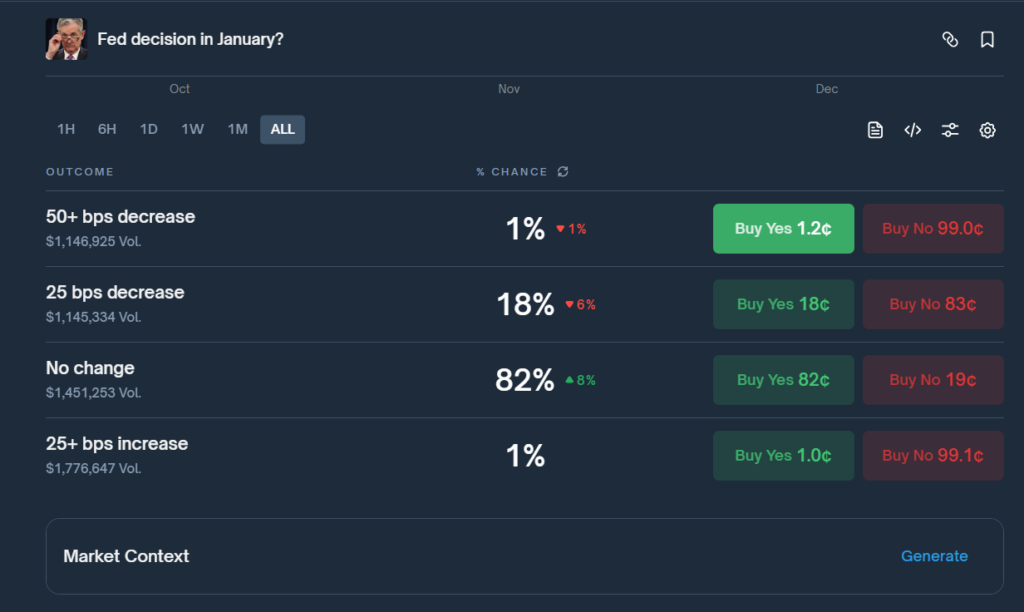

- Polymarket odds for a January price reduce have collapsed to 18 %, the bottom on file.

- Powell signaled persistence after the December reduce, reinforcing market doubts about instant easing.

- Upcoming labor and inflation information will decide whether or not odds rebound forward of the January FOMC assembly.

Expectations for one more Federal Reserve price reduce in January have dropped sharply, with Polymarket information exhibiting odds falling to only 18 %—an all-time low for the contract. This shift comes solely days after the Fed delivered its December reduce, marking a transparent cooling in market conviction that Chair Jerome Powell will proceed easing at first of 2026. The sudden repricing indicators a market adjusting to a extra cautious central financial institution narrative, particularly after Powell emphasised the necessity to look ahead to extra financial information earlier than committing to additional cuts.

Fed Break up Deepens as Powell Alerts No One Expects a Charge Hike

Throughout Wednesday’s press convention, Powell made one factor clear: he doesn’t see a price hike as any policymaker’s base case. Nevertheless, he additionally stopped in need of promising further cuts. With three dissenting votes within the newest FOMC resolution, the deepest division in additional than a decade, markets have begun scaling again expectations for early-2026 easing. Inflation stays above goal, and the labor market continues to melt, making a tough atmosphere for a central financial institution attempting to navigate competing dangers.

Political Strain and Financial Uncertainty Push Markets Into Wait-and-See Mode

President Donald Trump has intensified requires quicker and bigger price cuts, claiming the Fed’s most up-to-date transfer ought to have been “at the very least doubled.” But regardless of political stress, Powell signaled persistence, highlighting the necessity to observe how 2025’s cuts stream by means of the economic system. With inflation information distorted by the extended authorities shutdown and unemployment creeping as much as 4.4 %, traders are shifting from aggressive rate-cut bets towards a extra cautious stance mirrored within the new 18 % odds.

Markets Now Watching January Knowledge because the Key Deciding Issue

With the Fed’s Abstract of Financial Projections exhibiting just one anticipated reduce in 2026, merchants are actually ready on essential labor and inflation studies set to reach earlier than the January FOMC assembly. Any additional softness in employment may enhance reduce expectations once more, but when inflation stays sticky, the Fed might pause longer than beforehand assumed. This uncertainty has grow to be the first driver behind Polymarket’s steep decline in reduce projections.

What the New Odds Sign for Markets Going Into 2026

A drop to 18 % odds signifies a broad perception that January could also be too quickly for one more coverage shift. As an alternative, markets anticipate a extra staggered easing cycle later in 2026, doubtlessly influenced by whoever President Trump appoints as the subsequent Fed chair. With Kevin Hassett nonetheless seen because the frontrunner, the market might reverse rapidly as soon as readability emerges. For now, although, merchants seem aligned with Powell’s assertion that the Fed is well-positioned to attend and consider incoming information earlier than shifting once more.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.