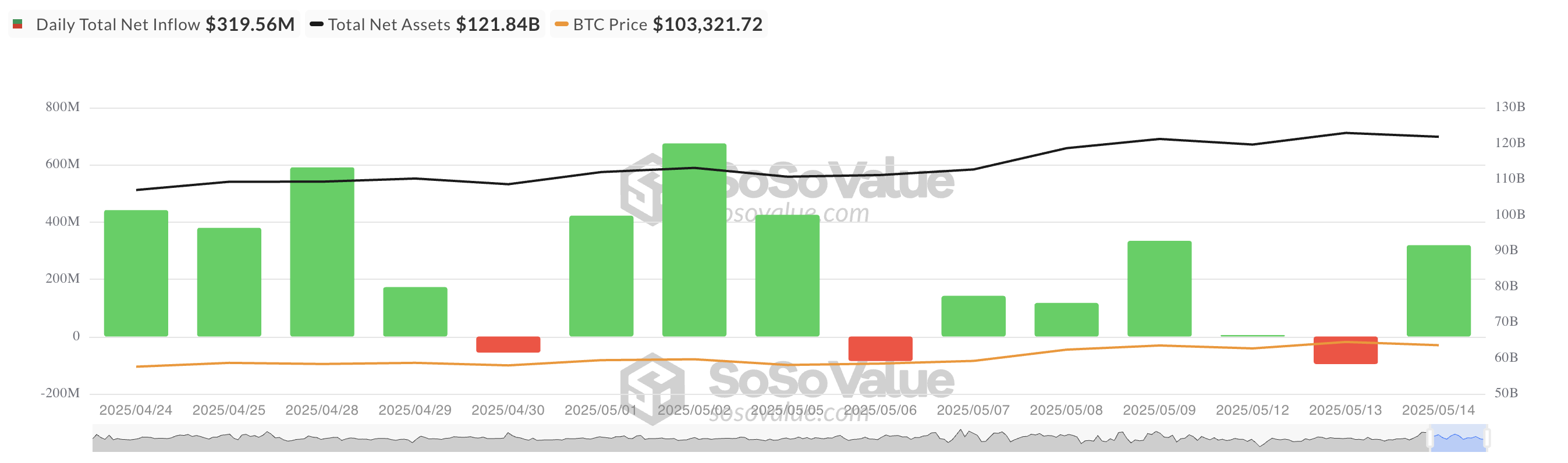

On Wednesday, inflows into US-listed Bitcoin ETFs exceeded $315 million, marking a pointy reversal from the $96 million in outflows recorded the day gone by.

The surge in demand displays a bullish shift in investor sentiment regardless of the modest decline in BTC’s value on Wednesday.

$319 Million Pours Into BTC ETFs in a Day

On Wednesday, not one of the twelve spot BTC-backed ETFs reported outflows. In response to SosoValue, inflows into these funds totaled $319.56 million, marking one of many strongest single-day performances in current weeks.

The shift in sentiment factors to renewed curiosity from retail and institutional buyers, doubtless pushed by an opportunity to purchase the dip and rising confidence in BTC’s long-term potential, regardless of short-term value swings.

Yesterday, BlackRock’s ETF IBIT noticed the best internet influx, amounting to $232.89 million. As of this writing, its complete historic internet influx is $45.01 billion.

Constancy’s FBTC noticed the second-highest each day internet influx, at $36.13 million, bringing its complete historic internet inflows to $11.65 billion.

BTC Pulls Again Barely, However Derivatives Present Bulls Are Not Backing Down

BTC at present trades at $102,413, noting a modest 1% value pullback over the previous day. Nevertheless, market knowledge factors to lingering bullish sentiment whereas spot costs dip.

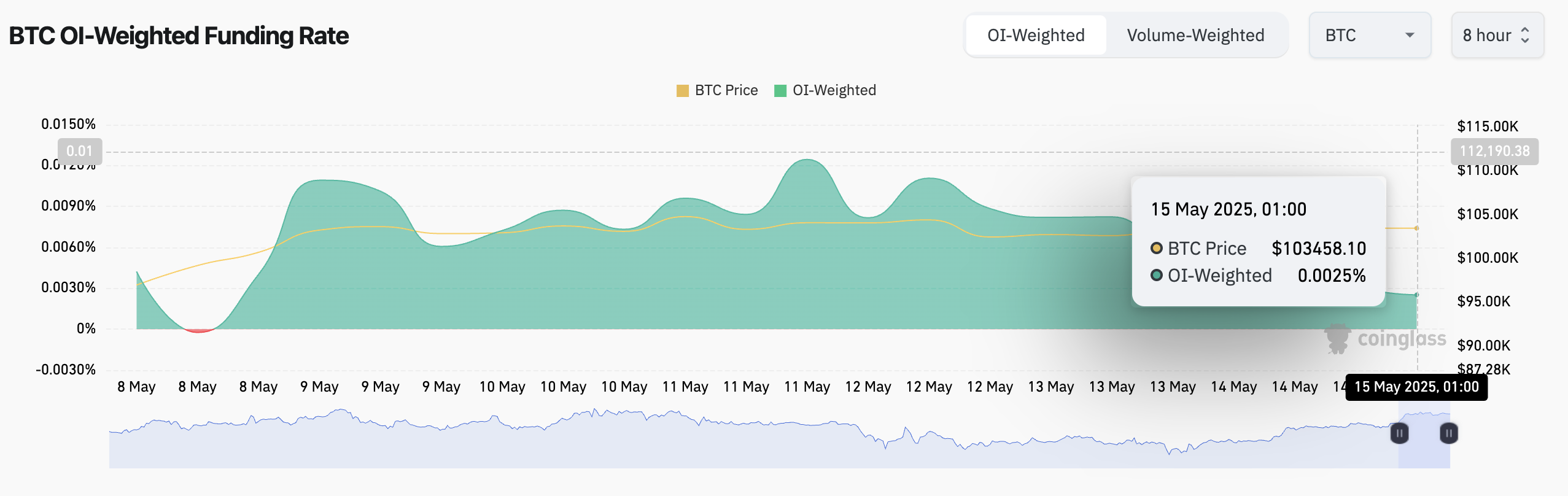

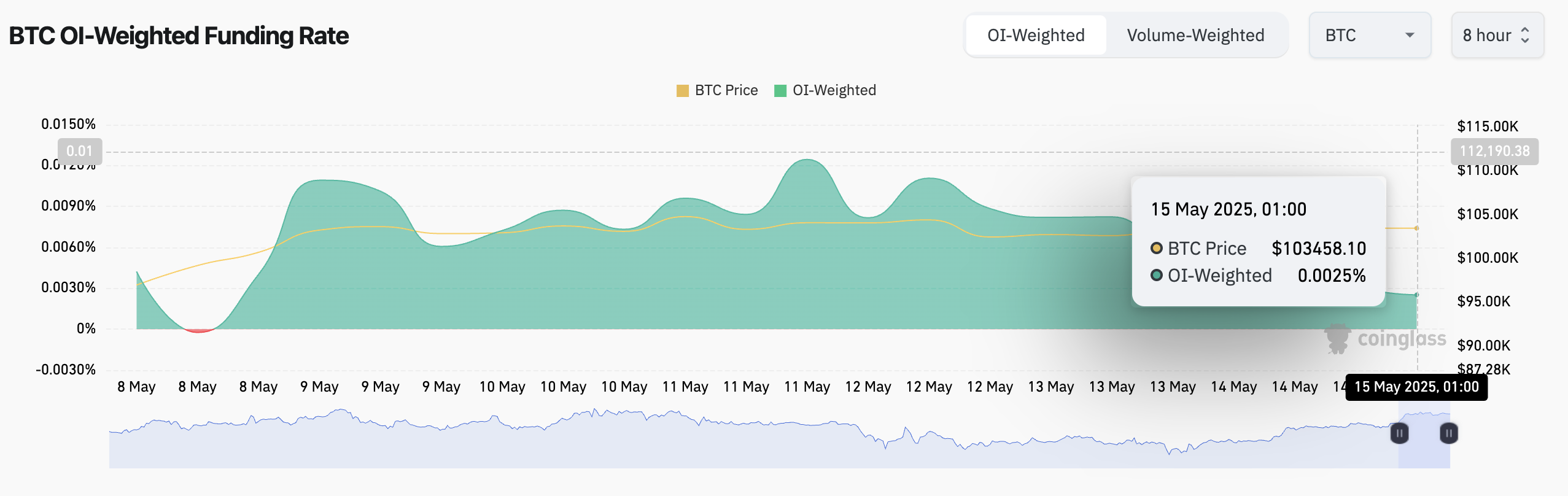

For instance, the coin’s funding fee stays optimistic, indicating merchants are nonetheless prepared to pay a premium to take care of lengthy positions in perpetual futures. At press time, that is at 0.0025%.

The funding fee is a periodic cost exchanged between merchants in perpetual futures contracts to maintain costs aligned with the spot market.

When its worth is optimistic like this, it signifies bullish sentiment and a better demand for longs. It signifies that merchants holding lengthy BTC positions pay these holding brief positions, a pattern that would enhance the coin’s worth.

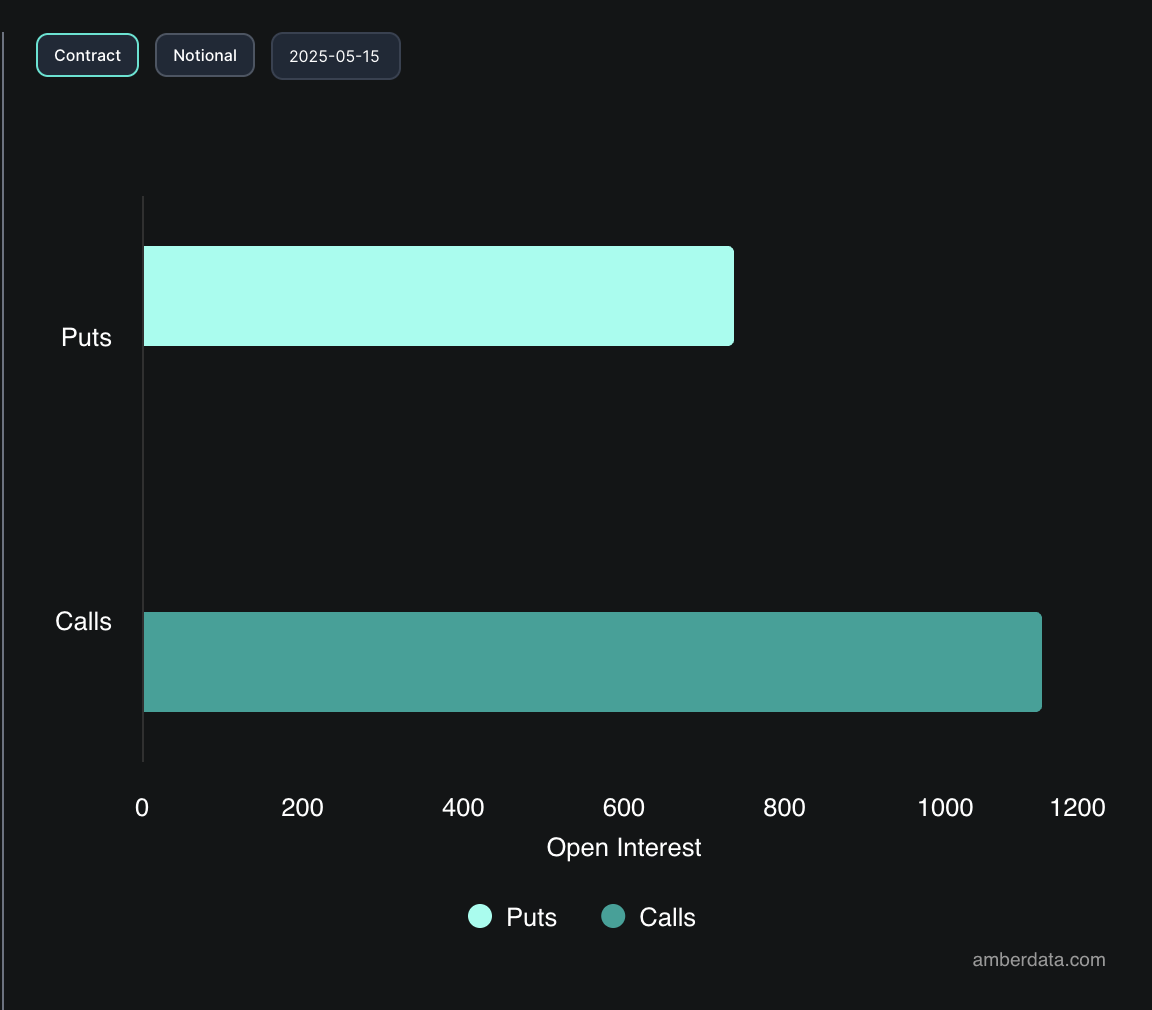

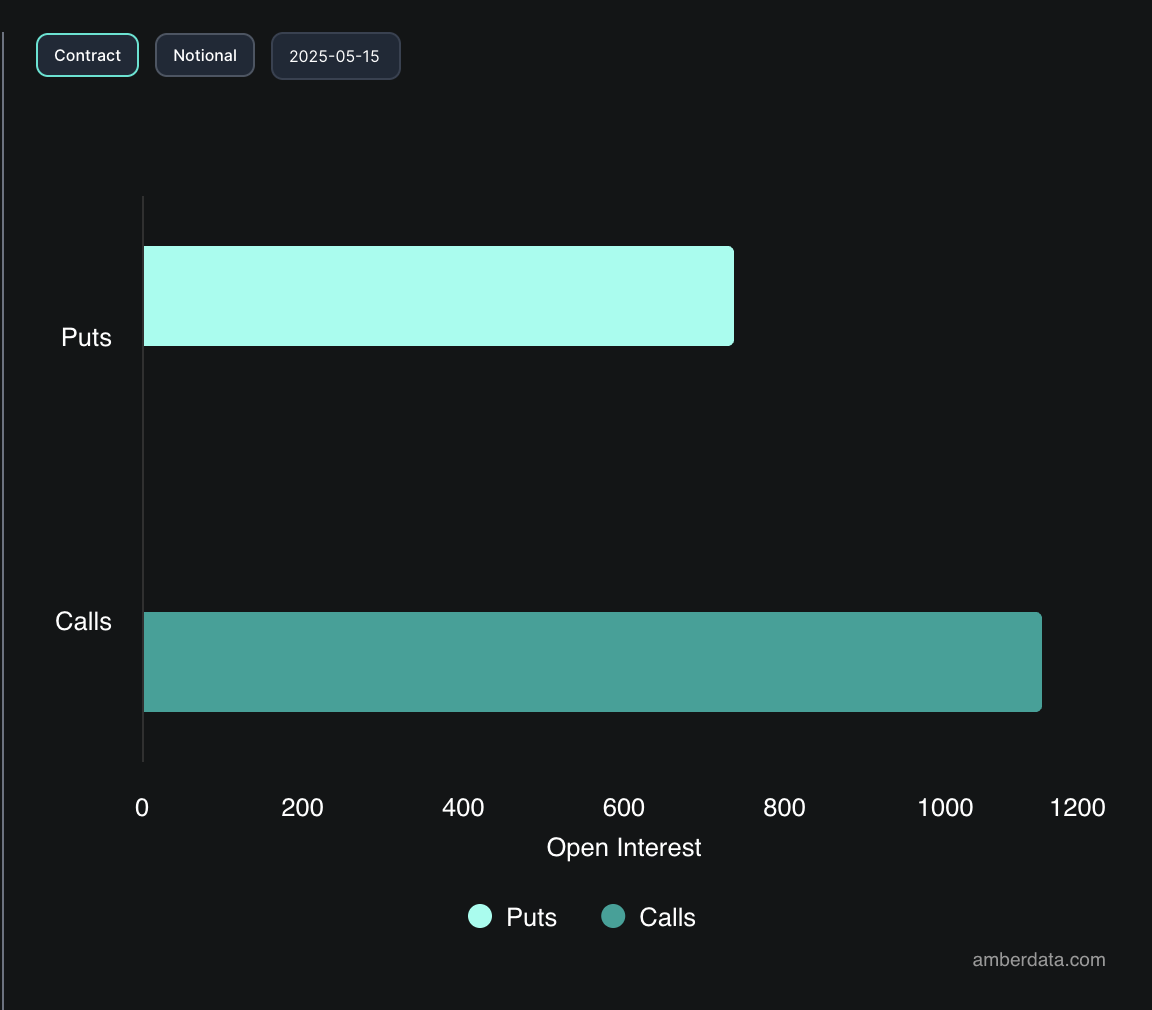

Moreover, choices exercise reveals larger demand for calls over places, suggesting merchants are positioning for potential upside within the close to time period.

In conclusion, the inflows counsel that institutional buyers could also be shopping for the dip, betting on a longer-term restoration in BTC value.

Disclaimer

According to the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.