Because the second week of August begins, the full crypto market capitalization has surpassed $4 trillion, formally setting a brand new all-time excessive. With buying and selling sentiment bettering, bullish expectations deepen the imbalance between lengthy and brief positions.

In consequence, some altcoins may face vital liquidations this week if costs transfer in opposition to the expectations of short-term leveraged merchants.

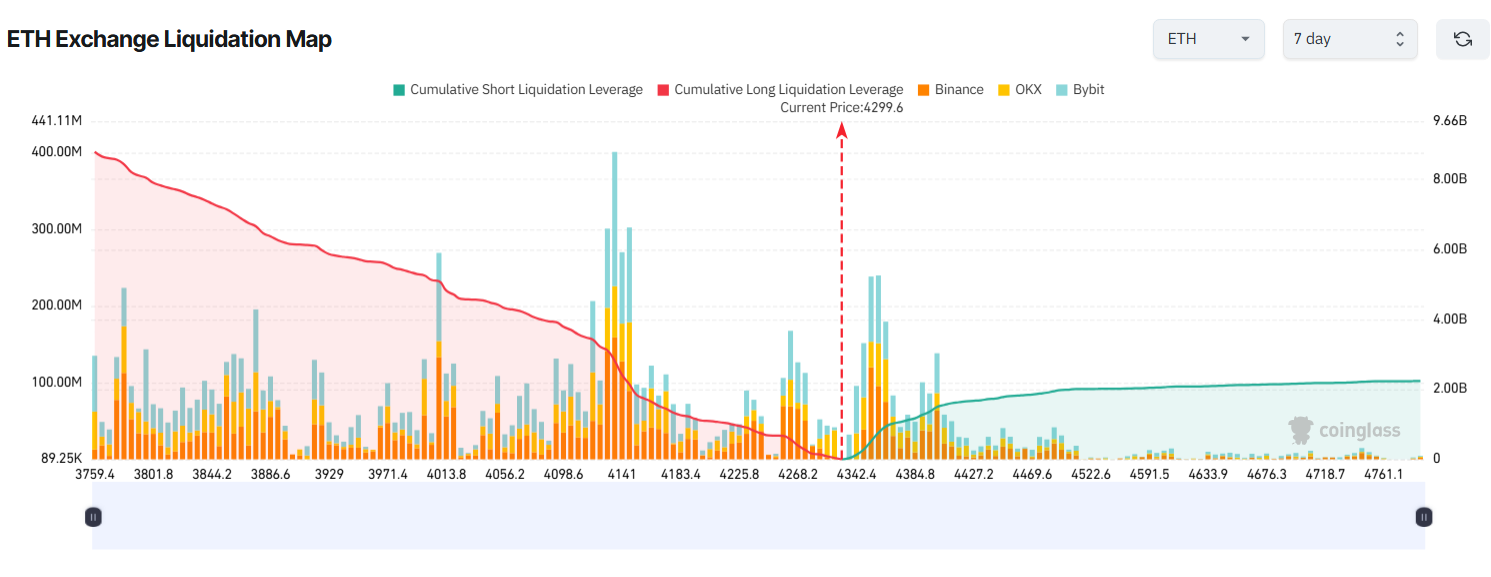

1. Ethereum (ETH)

Ethereum’s 7-day liquidation map exhibits a serious imbalance between collected liquidation volumes on the lengthy and brief sides. Merchants proceed to allocate capital and leverage to bets that ETH will maintain rising after breaking above $4,300.

Coinglass knowledge signifies that longs may lose over $5 billion if ETH drops 7% this week and falls under $4,000. In distinction, a 7% rise to $4,600 would set off $2 billion in liquidations for shorts.

Some merchants fear that liquidity flows primarily into ETH, whereas different altcoins don’t see the identical inflows. They consider ETH’s rally may lack sustainability if shopping for stress fades, doubtlessly resulting in a pointy drop and as a lot as $7 billion in lengthy liquidations.

“If Ethereum drops to $3,600, over $7 billion in lengthy positions can be liquidated — a extremely enticing liquidity pool for exchanges… Since liquidity has flowed primarily into ETH whereas different altcoins stay inactive, this means ETH may be positioning to steadiness the general crypto market cap in response to potential Bitcoin dominance strikes,” investor Marzell mentioned.

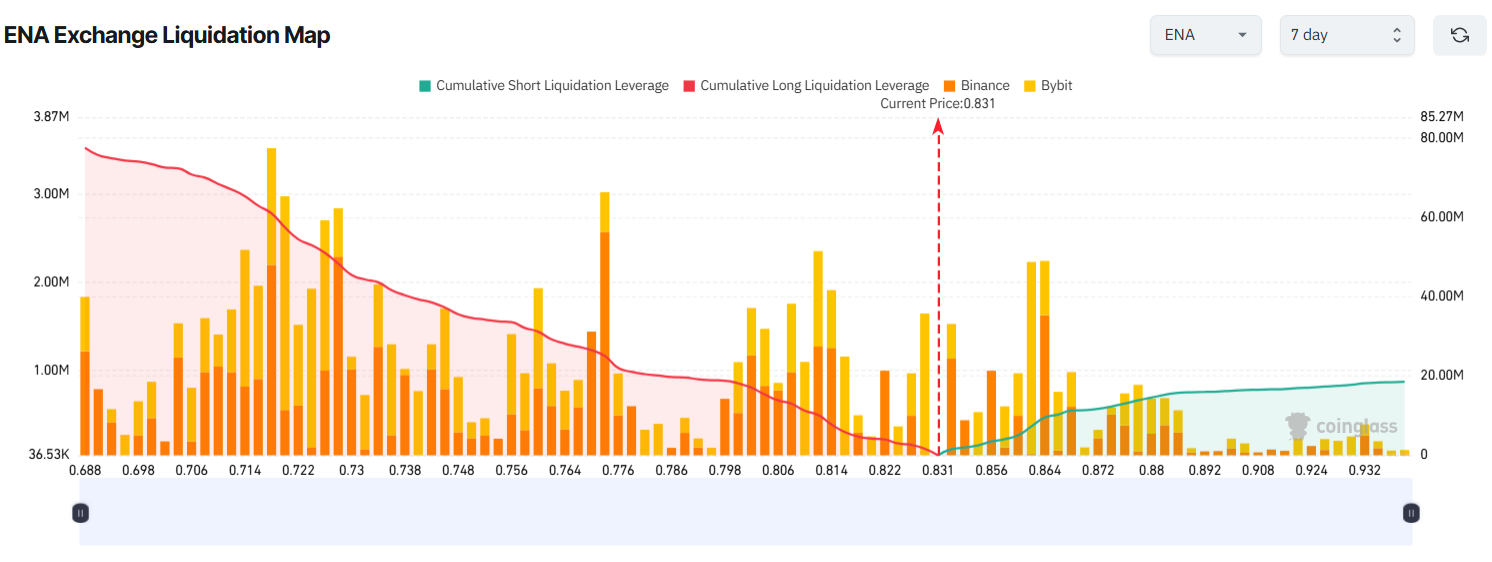

2. Ethena (ENA)

Ethena (ENA) has been one of the crucial talked-about altcoins in August. Because of the passage of the GENIUS Act on July 18, Ethena’s USDe stablecoin reached a $10 billion market cap, changing into the third-largest stablecoin after USDT and USDC.

The bullish sentiment for ENA has surged, pushing its value from $0.50 to over $0.80 in August. A current BeInCrypto report confirmed that whales are nonetheless accumulating ENA, and the liquidation map displays merchants’ expectations of additional short-term features.

ENA’s 7-day liquidation map exhibits that longs’ whole collected liquidation quantity far exceeds that of shorts.

If ENA falls to the psychological help degree of $0.70 this week, longs may face over $70 million in losses. Alternatively, if ENA climbs to $0.90, shorts would lose simply $16.5 million.

Some merchants consider ENA may maintain rallying towards $1.50. Nonetheless, they warn that the token may face profit-taking stress within the $0.80–$0.90 vary.

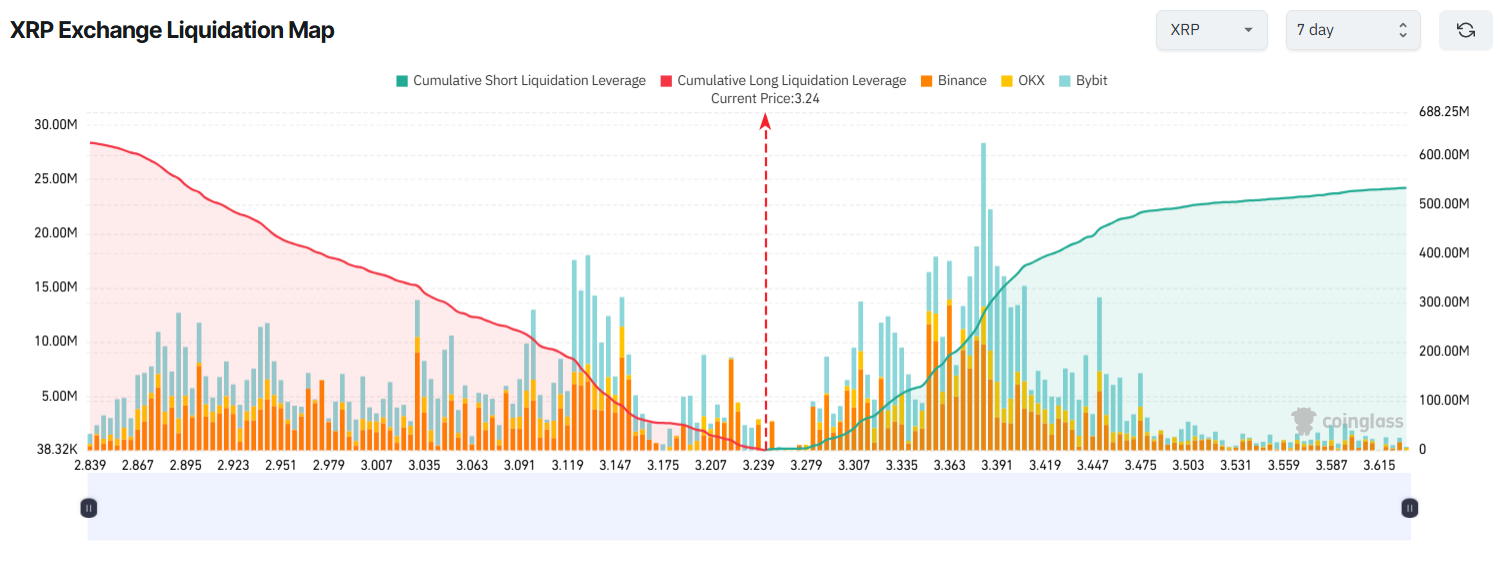

3. XRP

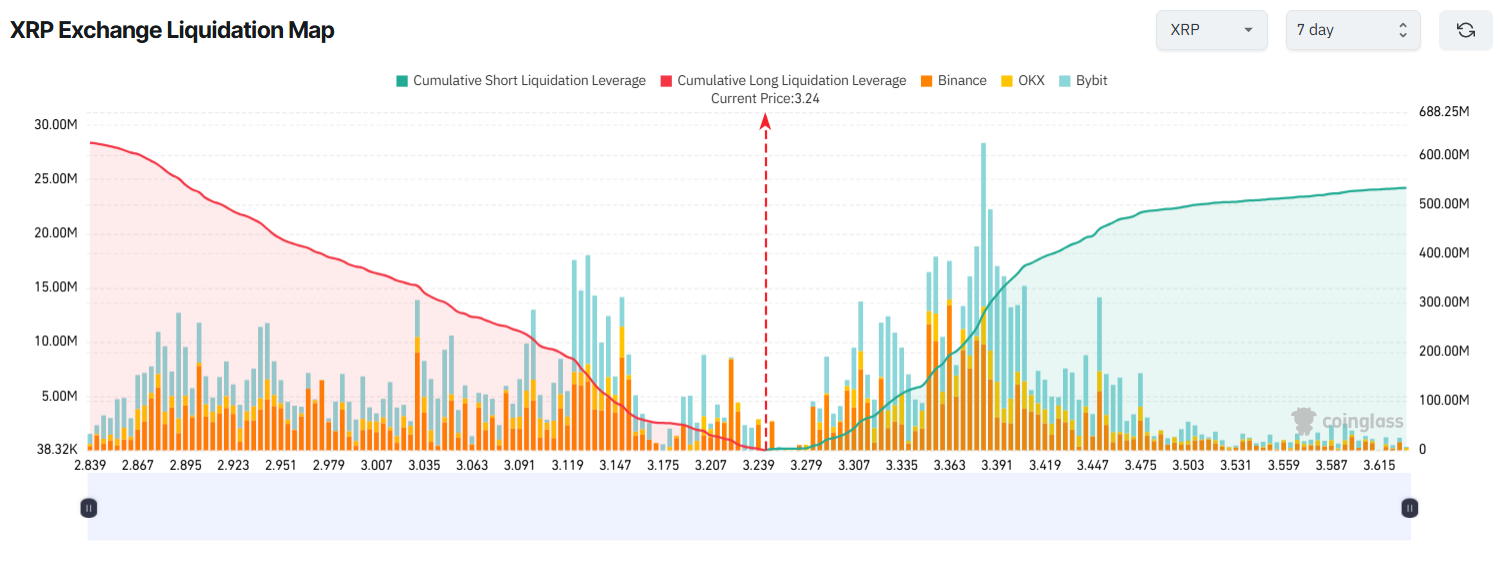

Whereas many altcoins present imbalances of their liquidation maps skewed towards bullish expectations from short-term merchants, XRP presents a special image.

A current BeInCrypto report revealed that Ripple unlocked 1 billion XRP, sparking issues of downward stress. Technical indicators additionally counsel that sellers may quickly take management.

Probably for these causes, XRP’s 7-day liquidation map exhibits that merchants are inserting more cash on a bearish state of affairs.

If XRP strikes in opposition to these bearish bets, shorts may endure heavy losses this week.

Particularly, if XRP rises 8% to hit $3.50, almost $500 million in shorts can be liquidated. Conversely, if XRP drops 8% to $3.00, longs would face about $370 million in liquidations.

The publish 3 Altcoins at Danger of Main Liquidations in The Second Week Of August appeared first on BeInCrypto.

Supply hyperlink